2 Ministerial Decisions published in 2025 have put the UAE on the road to mandatory e-invoicing, with rollout planned in 2026 & 2027.

Continue readingKSeF 2.0 launched on February 1, 2026 in Poland

Beware of the latest development regarding the transition from the voluntary phase to Poland B2B e-invoicing mandate on February 1, 2026.

Continue readingA tense launch for Croatia’s e-invoicing mandate

Croatia made e-invoicing mandatory for B2G, B2B and B2C transactions just six months after the law passed, which is proving ambitious.

Continue readingMandatory e-invoicing takes effect in Belgium

Since January 1, 2026, all Belgium companies are obliged to exchange invoices electronically, primarily through the Peppol network.

Continue readingE-invoicing in Croatia from January 1, 2026: The Complete Guide

B2G, B2B, B2C, tax data reporting, payment reporting, clearance, invoice rejection, product classification and more: Croatia embraces it all!

Continue readingVeri*Factu faces another delay, now pushed to 2027

Spanish Parliament has approved a one-year postponement of Verifactu mandate, giving more time for companies to implement certified software.

Continue readingUnderstanding the e-invoicing clearance model in Israel

The Invoicing Hub now covers a 24th country: Israel, with regular e-invoicing news & detailed country profile.

Continue readingUK government announces a B2B e-invoicing obligation for 2029

As the EU implements ViDA, the UK is preparing to introduce its own e-invoicing mandate applying to all VAT invoices from 2029.

Continue readingFresh publications further clarify France’s 2026 e-invoicing requirements

DGFiP and AFNOR’s latest publications provide companies and accredited platforms with clearer guidance as the complex mandate approaches.

Continue readingE-Invoicing Compliance in Greece: The Complete Guide

The Invoicing Hub now covers a 23rd country: Greece, with regular e-invoicing news & detailed country profile.

Continue readingUnderstanding Poland’s 2026 B2B e-invoicing requirement

Starting in 2026, Poland will require all B2B invoices to be exchanged through KSeF, after the mandate was postponed from its 2024 launch.

Continue readingBelgium’s 2026 e-invoicing mandate: a recap

With less than 4 months to the January 2026 Belgium e-invoicing mandate deadline, now is a good time for businesses to review what’s ahead.

Continue readingFrance publishes updated technical standards for 2026 mandate

New versions of the pivotal standards XP Z12-012 (“Formats and Profiles”) and XP Z12-014 (“Use Cases”) were officially released.

Continue readingMapping German mandatory VAT data to EN 16931

A practical guide streamlines B2B invoicing implementations in Germany recommending uniform mappings of mandatory fields to the EN 16931-1.

Continue readingNew Country Coverage: Colombia

The Invoicing Hub now covers a 22nd country: Colombia, with regular e-invoicing news & detailed country profile.

Continue readingPeppol Conference 2025: mandates, ViDA and maturity

Increasing adoption, public interest and growing membership drew many active contributors as well as newly engaging experts-to-be into this biggest ever gathering of the Peppol Network community.

Continue readingKSeF 2.0 and FA(3) finalized: time for businesses to start implementation

Poland moves forward with e-invoicing mandate as the Ministry of Finance releases key technical documentation to help companies prepare.

Continue readingStart of voluntary e-reporting in Singapore

Voluntary e-Reporting via InvoiceNow is effective from May 2025, using either the Peppol BIS 3.0 or the PINT-SG format.

Continue readingFrench mandate latest specifications released during JFE 2025

JFE 2025 gathered nearly 2,000 attendees and key speakers, including DGFiP, who shared updates on the upcoming B2B mandate.

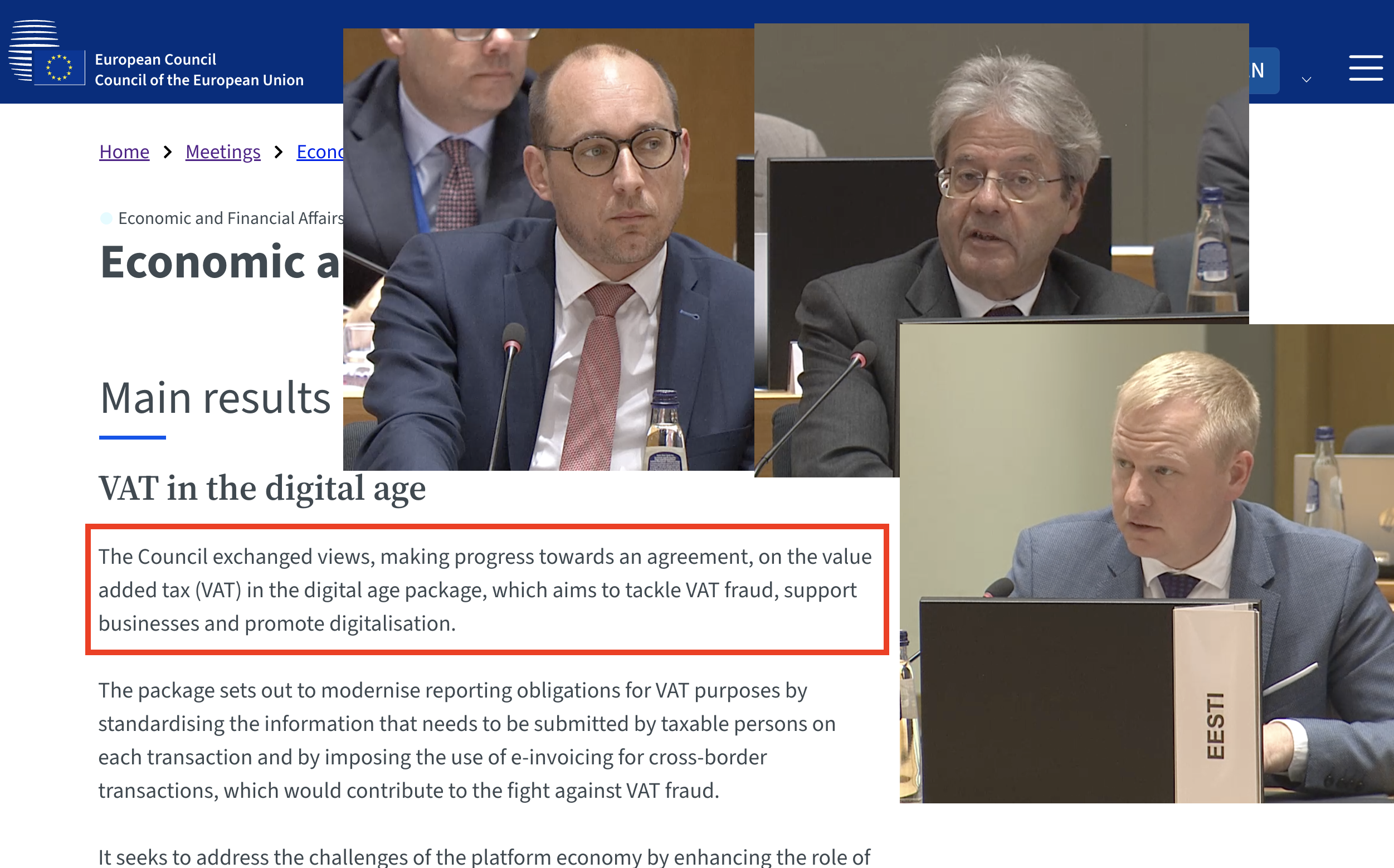

Continue readingViDA clears final step in European Council

The European Council today formally confirmed adoption of the “VAT in the Digital Age” (ViDA) package, completing the process started in 2022.

Continue readingBelgium announces plans to introduce mandatory e-reporting by 2028

The Belgian federal government plans to expand upcoming e-invoicing

regulations with a five-corner model by 2028 to combat tax evasion.

New Country Coverage: India

The Invoicing Hub now covers a 20th country: India, with regular e-invoicing news & detailed country profile.

Continue readingE-Invoicing & E-Reporting in France: The Complete Guide

The announcements from the DGFiP made in Q4 2024 bring significant changes to France’s e-invoicing and e-reporting mandates.

Continue readingA brief summary of e-invoicing changes introduced on January 1, 2025

The transition to 2025 brings significant e-invoicing updates into effect in several countries, primarily in Europe and Southeast Asia.

Continue readingViDA package finally adopted by the European Council

A compromise has been reached among all EU member states before the final vote by the Parliament.

Continue readingFrance reveals a significantly scaled-back scope for its B2B central platform

The PPF will only manage the central directory and receive invoice tax data, while the PDPs will process invoices for all companies countrywide.

Continue readingNew Country Coverage: United Kingdom

The Invoicing Hub now covers a 19th country: the United Kingdom, with regular e-invoicing news & detailed country profile.

Continue readingFrance unveils a first list of 60+ PDPs

All the PDPs in the list are provisionally registered until further connectivity tests are validated in 2025.

Continue readingThe Invoicing Hub at the E-Invoicing Exchange Summit, Prague (Sept 23-25, 2024)

The Invoicing Hub will attend the E-Invoicing Exchange Summit in Prague, with co-founder Michael Walther leading a B2B interoperability roundtable.

Continue readingMalaysian e-invoicing mandate now effective for large companies

Starting from August 1, all Malaysian companies with a revenue exceeding RM 100 million will have to submit their e-invoices through the MyInvois central platform.

Continue readingE-Invoicing Compliance in Austria: The Complete Guide

The Invoicing Hub now covers a 18th country: Austria, with regular e-invoicing news & detailed country profile.

Continue readingDraft details published: clearing the fog for B2B mandate in Germany

On 13.6.2024, the Federal Ministry of Finance (“BMF”) published the draft of an official letter aiming to clarify open questions surrounding the upcoming e-Invoicing mandate.

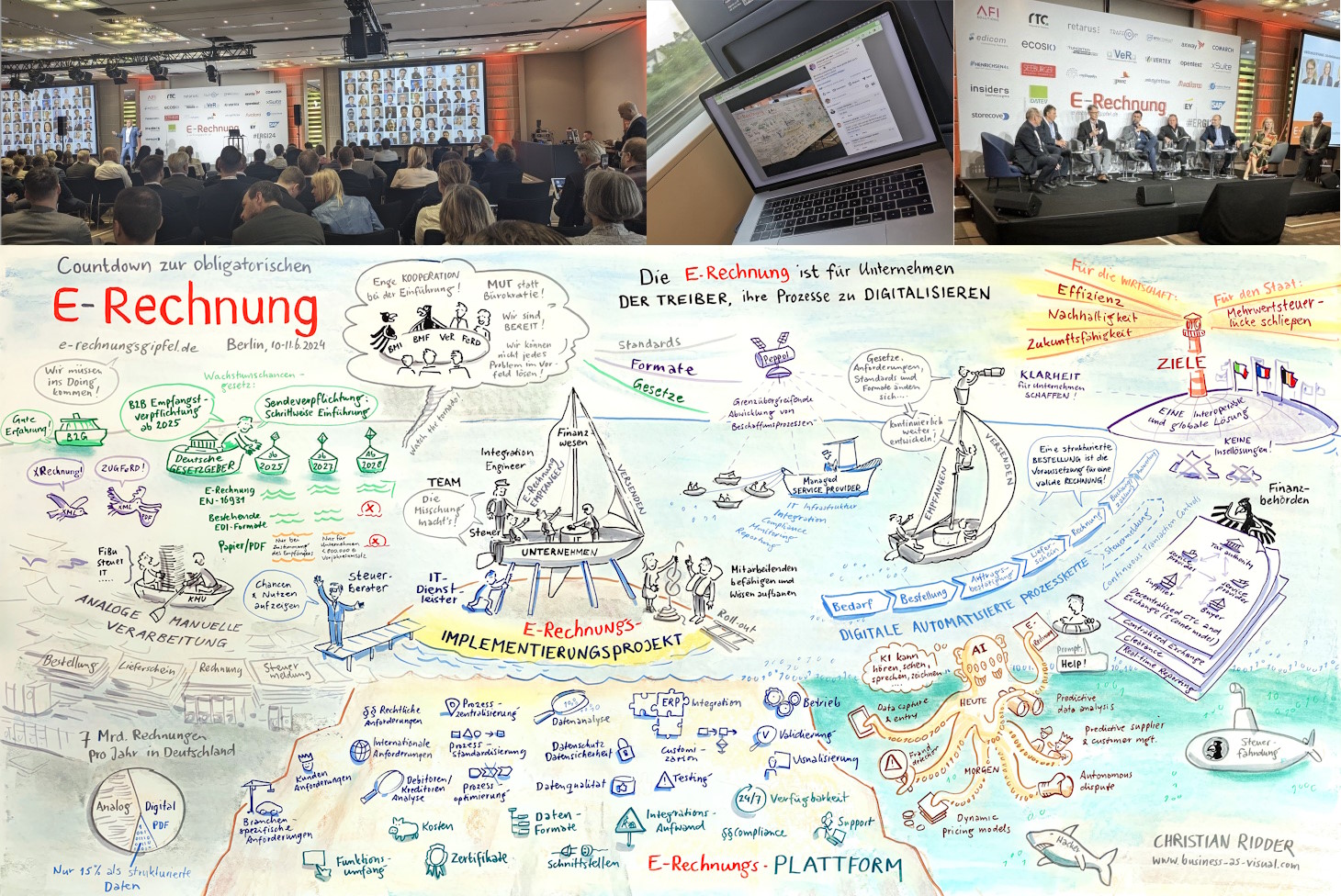

Continue readingE-Rechnungsgipfel 2024: countdown to B2B e-Invoicing in Germany

Taking stock of progress to date, the German e-Invoicing community gathered in Berlin for their traditional e-Rechnungsgipfel on June 10/11, 2024, with many discussions revolving around the upcoming B2B e-invoicing mandate.

Continue readingGENA General Assembly Highlights

The Global Exchange Network Association (GENA) held its General Assembly in Utrecht (NL) on June 6, bringing together a wide range of leading e-invoicing players in the market.

Continue readingPeppol Conference 2024 key takeaways

Evolution of the Peppol BIS format and a potential merger of OpenPeppol & GENA were some of the main announcements made during the Peppol Conference 2024.

Continue readingECOFIN meeting on 14.5.2024 does not adopt ViDA (yet)

The “VAT in the Digital Age” (ViDA) package achieved unanimous agreement on Digital Reporting (DRR) and Single VAT registration but failed to be adopted due to Estonia’s concerns on tax rules for “deemed suppliers” in digital platforms.

Continue readingE-invoicing will become mandatory in Poland in 2026

New dates have been set at the beginning of 2026 for the implementation of the e-invoicing mandate in Poland.

Continue readingSingapore moves towards mandatory e-reporting of invoicing data

The Singapore Tax Authority (IRAS) has announced an upcoming “GST InvoiceNow Requirement” which will gradually enforce businesses to automatically transmit their e-invoicing data.

Continue readingIt’s official: B2B Electronic Invoicing starts on 1.1.2025 in Germany

Today, on 22.3.2024, the German Bundesrat approved and finalized the German Growth Opportunities Act (Wachstumschancengesetz) including strong political moves towards digitalization of both the private and public sector.

Continue readingYet another step cleared for German B2B e-Invoicing mandate

German B2B e-Invoicing mandate inches closer to start on 1.1.2025 – even though legislation is in “over time”

Continue readingFrance B2B mandate: recent calendar updates

The French B2B mandate will be implemented in 2026 & 2027

Continue readingBelgium formally adopted B2B mandate starting 1.1.2026

In Belgium, the Chamber of Representatives approved and published the B2B mandate to start on 1.1.2026.

Continue reading