Understanding the European Norm 16931

Last update: 2024, September 16

Summary

EN 16931 is a European standard for electronic invoicing established by the European Committee for Standardization (CEN).

It defines the core elements and semantic data model for electronic invoices, ensuring interoperability across different systems within the EU.

Widely used in public procurement and private businesses, it optimizes invoicing processes, reduces errors, and ensures compliance with regulatory requirements, supporting seamless exchange of invoices across Europe.

EN 16931 in the Context of E-Invoicing

In the digital age, efficient financial information exchange, including electronic invoicing, is crucial for business operations and economic growth. At the heart of standardizing e-invoicing practices in Europe is the European Norm (EN) 16931.

It was developed by the European Committee for Standardization (CEN), and it represents a significant leap towards harmonizing the structure and exchange of electronic invoices across the European Union.

But what exactly is the EN 16931, and how does it apply to e-invoicing?

Origin of the EN 16931

The development of EN 16931 was driven by the European Directive 2014/55/EU, which required all member states to implement e-invoicing for business-to-government (B2G) transactions.

To ensure consistency across the EU, the directive mandated the creation of a “core invoice” specification for these B2G cases, with future applications in B2B transactions in mind. CEN was tasked with developing this specification, leading to the publication of EN 16931 in 2017, a key milestone in the EU’s Digital Single Market strategy.

Simultaneously, in 2014, deadlines for B2G implementation were established for member states, with a maximum transposition period extending to 2019. As a result, all B2G implementations are now required to adhere to EN 16931.

By standardizing invoice content & formats, the EN 16931 greatly reduces complexity, processing times and invoicing costs, enhancing the accuracy and efficiency of business processes. This standard not only facilitates global trade and promotes economic growth but also makes it easier for tax authorities and government entities to retrieve essential e-reporting information.

Directive 2014/55/EU

Publication of the EN 16931

B2G mandatory in Europe

EN 16931 "Core Invoice"

The EN 16931 primary goal is to ensure that electronic invoices are universally comprehensible and processable across different systems and countries within the EU.

At the heart of the norm is the “core invoice”, a semantic data model that defines the core elements (the fields) required in an electronic invoice.

These elements include:

- Invoice number and date

- Supplier details (name, address, VAT number)

- Customer details (name, address, VAT number)

- Invoice line items, including

- Product or service description

- Quantity and unit price

- Line item amounts

- Total amounts (net, gross, VAT)

- Payment terms and instructions

- Delivery information

- Tax details (rates, categories)

- Additional supporting documents or references

This standardized data model ensures that all essential information is consistently presented, regardless of the specific software or platform used to create or process the invoice. The standard also includes a comprehensive definition of the structure of the information in electronic invoices, ensuring that they can be exchanged and processed seamlessly across different systems.

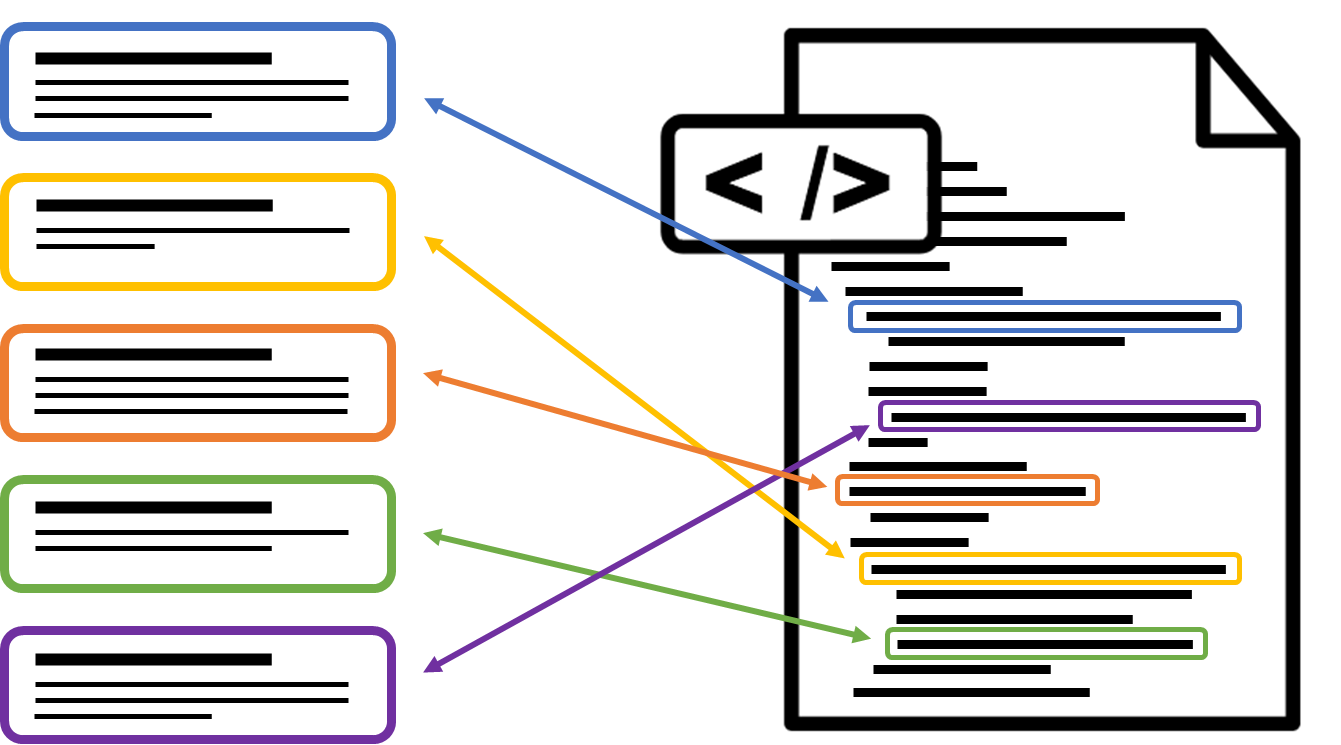

Mappings to Compliant Invoice Syntaxes

To ensure practical implementation, the EN 16931 specifically outlines mappings to 2 popular invoice syntaxes (or “formats”) of electronic invoices: UBL & CII. The EN 16931 also requires these to be supported by public administrations.

Although other syntaxes, such as EDIFACT, were considered, they were ultimately not listed as “compliant”. Mappings to those syntaxes exist but are not complete, leaving several gaps up to interpretation. Therefore, it is not mandatory for public administrations to support those.

UBL (Universal Business Language)

UBL is an XML-based format developed by OASIS and widely adopted for electronic business documents. It’s particularly popular for cross-border transactions due to its support for multiple languages and currencies. The Peppol BIS Billing 3.0, which uses UBL syntax, has become a prominent e-invoicing format compliant with the EN 16931, facilitating international trade.

CII (Cross Industry Invoice)

CII (Cross Industry Invoice) is another XML-based syntax, this time developed by UN/CEFACT. It’s favored by large organizations and industries with specific invoicing needs, such as manufacturing and logistics. Formats like ZUGFeRD in Germany and Factur-X in France utilize CII to meet specific regulatory and business requirements.

EN 16931 Variations & Challenges

Although the EN 16931 aims to promote uniformity, many countries, organizations, or sectors adapt it in order to meet their specific regulatory and operational requirements.

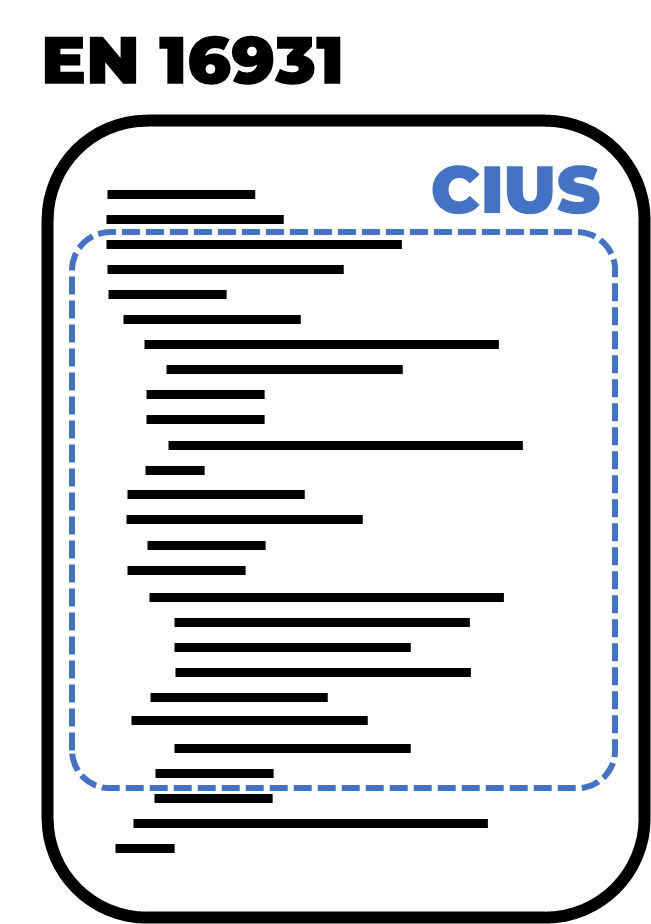

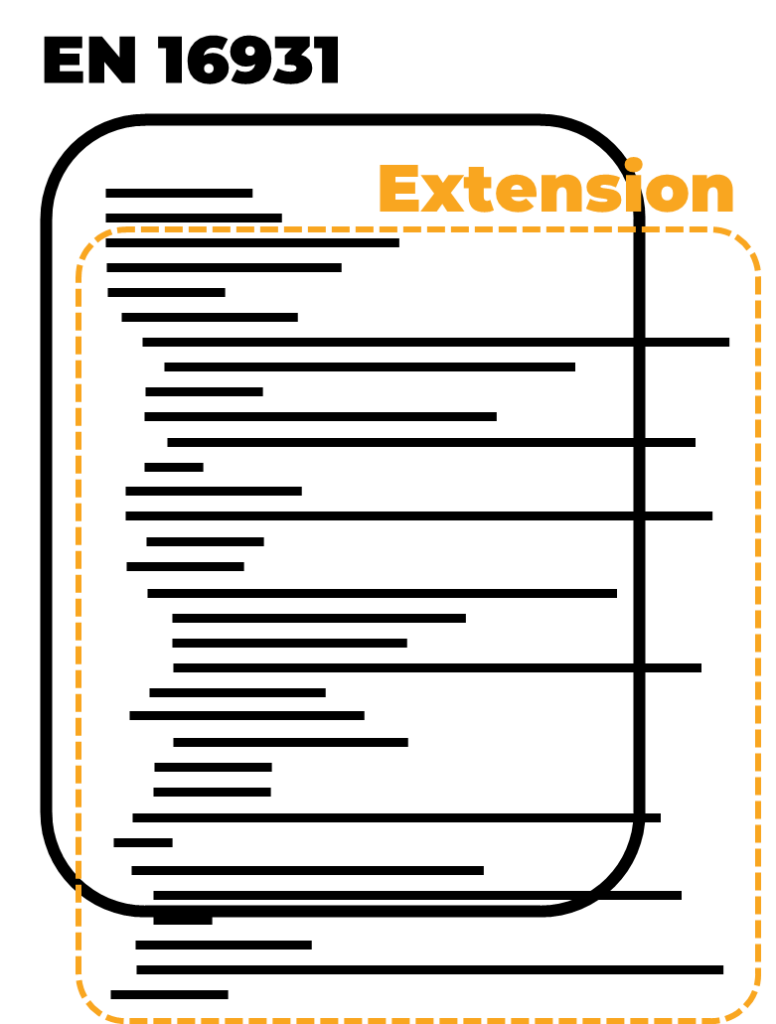

This has resulted in the development of variations within the EN 16931-compliant syntaxes, either by reducing the data through Core Invoice Usage Specifications (CIUS) or by expanding it through Extensions.

The European Commission has established an official registry of CIUS and Extensions.

Core Invoice Usage Specifications (CIUS)

Essentially, a CIUS is an invoice syntax that refines the EN 16931 standard by defining which elements are mandatory, which are optional, and how certain data should be formatted or processed. This customization enables more precise control over e-invoicing practices within a particular context, such as a specific country or industry, without violating the core principles of EN 16931.

The philosophy behind CIUS is that any system designed to process EN 16931-compliant invoices can also natively handle invoices that follow any CIUS. This is because CIUS invoices are essentially EN 16931 invoices with more rules and fewer choices on data fields. However, the data specified in a CIUS remains adequate to ensure legal compliance and operational self-sufficiency.

Examples of CIUS, which, by definition, are compliant with the EN 16931:

- The cross-border Peppol BIS 3.0 invoice syntax, used on the Peppol Network

- The Portuguese “CIUS-PT” used in the national B2G e-invoicing mandate context

- The hybrid PDF/XML formats ZuGFeRD (Germany) and Factur-X (France)

Extensions

Inherent Challenges remaining

Although EN 16931 provides a standardized framework and core definitions for electronic invoicing, its implementation still poses challenges. Many countries and industries specialize the norm to fit their specific regulatory and operational needs, resulting in country-specific variations in the form of CIUS and Extensions. These modifications complicate compliance for businesses operating across borders, as different countries may impose unique technical requirements, reporting obligations, and additional regulations.

The upcoming B2B e-invoicing mandate in Germany highlights this issue, requiring companies to use EN 16931-compliant invoices but without specifying a mandatory invoice format. This flexibility allows businesses to choose any EN 16931-compliant format, provided both buyer and seller agree, adding to the complexity, particularly when dealing with multiple trading partners.

Even though systems capable of processing EN 16931 invoices should also handle CIUS and Extensions, this variety in invoice formats creates a complex landscape of e-invoicing practices. Meeting these diverse national requirements still requires significant administrative effort and the adoption of multiple technical solutions.

The EN 16931 ensures that there is a consistent core covering many common use cases already.

How to Comply with the EN 16931?

Directive 2014/55/EU establishes requirements for EU member states rather than directly for businesses within the EU. It mandates that these member states must create and enforce national regulations requiring the use of EN 16931-compliant invoice formats for transactions between businesses and government entities (B2G e-invoicing).

Each member state is responsible for implementing these regulations according to its own legal and administrative frameworks, which includes selecting or, in some cases, developing invoice formats that comply with EN 16931 for businesses to use in B2G transactions.

Businesses must then comply by adopting technology that can process invoices in the formats specified by their national regulations, ensuring their electronic invoicing systems meet the required standards.

For instance, The Netherlands have required all businesses to use the Peppol BIS 3.0 format for B2G e-invoicing, which is compliant with the EN 16931.

This requirement applies to all EU countries, though some, such as Germany and Slovenia, did not meet the 2020 deadline set by the Directive 2014/55/EU and had to request extensions.

Directive 2014/55/EU issued by the European Union

The Directive mandates member states to create and enforce national regulations requiring the use of EN 16931-compliant invoice formats for B2G e-invoicing

All European Union member states must comply with the directive

Each country must implement the Directive but is free to select or even develop invoice formats that complay with EN 16931

Businesses must comply with the specific requirements of their own country

Companies must process invoices in the formats specified by their national regulations

Directive 2014/55/EU issued by the European Union

The Directive mandates member states to create and enforce national regulations requiring the use of EN 16931-compliant invoice formats for B2G e-invoicing

All European Union member states must comply with the directive

Each country must implement the Directive but is free to select or even develop invoice formats that complay with EN 16931

Businesses must comply with the specific requirements of their own country

Companies must process invoices in the formats specified by their national regulations

EN 16931 Documentation

EN 16931 was developed by CEN/TC 434, the Technical Committee 434 of the European Committee for Standardization (CEN).

The standard is divided into six parts, two of which are distributed for free by the CEN:

- Part 1: Semantic Data Model of the Core Elements of an Electronic Invoice

- Part 2: List of Syntaxes Compliant with EN 16931

Future of E-Invoicing with the EN 16931

E-Invoicing Mandates

EN 16931 is increasingly being adopted globally, with many countries aligning their e-invoicing standards core, recognizing it as a potential global benchmark.

All EU member states have implemented EN 16931 for B2G e-invoicing, and countries such as Belgium, France, and Germany are also planning to use it for future B2B mandates.

Additionally, EN 16931 is also gaining traction beyond Europe, particularly in the APAC region, where Australia, New Zealand, and Singapore are already using the Peppol BIS standard, which complies with the EN 16931, for their national e-invoicing systems.

E-Reporting

Many countries are transitioning to real-time or near-real-time reporting of invoice data to tax authorities, known as Continuous Transaction Controls (CTC). This shift is transforming tax compliance and auditing practices.

Countries like Italy have already implemented this approach in line with the EN 16931, while others such as France and Spain plan to adopt it for their e-reporting requirements.

More CIUS & Extensions

The EN 16931 will keep evolving to address emerging business needs through new CIUS & Extensions that will ensure the invoices syntaxes remains relevant in a rapidly changing digital landscape.

There are also efforts to expand its application beyond public procurement to new sectors and transaction types.

The Invoicing Hub Word

EN 16931: A Key Driver for Global E-Invoicing Standardization

The EN 16931 has emerged as a transformative force in European business practices, standardizing e-invoicing processes and paving the way for more efficient, accurate, and secure financial transactions.

As its adoption continues and its influence spreads globally (even outside the European Union), EN 16931 is not just a norm – it’s a catalyst for digital transformation in business operations.

However, challenges remain in the implementation of EN 16931. While the norm provides a common framework and solid core definitions, many countries are implementing their own specific e-invoicing requirements based on EN 16931. This still leaves considerable complexity to businesses operating across multiple countries, as they must deal with various country-specific CIUS and extensions of the standard.

Despite these challenges, the overall trajectory is clear: EN 16931 plays a pivotal role in shaping the future of business transactions in Europe and beyond, driving efficiency and transparency in financial processes.

Additional Resources

2014 EU Directive mandating the use of EN 16931 for B2G e-invoicing

European Committee for Standardization, whose Technical Committee 434 developed the EN 16931

Non-exhaustive list maintained by the European Commission

Get your Project Implemented

Gold Sponsor

With expert technical support and tailored consulting, we help global and local companies meet Mexico’s invoicing mandates with ease and efficiency. Whether you're operating in Mexico or need to invoice Mexican partners, we ensure full compliance and operational continuity.

Start of voluntary e-reporting in Singapore

Webinar — France’s E-Invoicing Revolution: are you ready for the compliance storm?

Webinar – Cracking the Code of Germany’s E-Invoicing Mandate

New Country Coverage: Mexico

E-Invoicing named key enabler in EU’s Single Market Strategy

The Invoicing Hub

experts can help you

Strategy, Guidance, Training, …