E-Invoicing in Croatia

Last update: 2026, January 6

Summary

B2G & B2B

Mandatory

Electronic invoices must be sent in HR-CIUS format (UBL or CII), preferably through the local eDelivery network, with real-time reporting to the ePorezna central platform and additional obligations.

B2C

Mandatory

Mandatory following a Clearance model, with pre-validation by the ePorezna central platform, before delivery of the invoice by the issuer with a unique identifier / QR code.

What the Law Says

B2G & B2B E-Invoicing (from 2026)

On January 1, 2026, a new mandate was introduced by the Ministry of Finance, Croatia’s tax authority, requiring all companies countrywide, both private and public, to issue and exchange domestic electronic invoices using the HR-CIUS UBL format, compliant with EN16931.

These invoices must be transmitted through a chosen delivery channel, with a local version of the Peppol network being highly recommended, and invoice data must also be reported in real-time to the tax authority via ePorezna [↗︎] (eTax), the tax authority portal.

This process, referred to as “Fiscalization” by the tax authority, is governed by the Fiscalization Act 2.0 [↗︎] and introduces multiple additional requirements, most notably:

- Registration of the e-invoice reception address in the central public directory called AMS (Adresar Metapodatkovnih Servisa)

- Transmission of invoice data to the tax authority by both the invoice issuer and the receiver for cross-validation

- Classification of items using KPD categories

- Notification of invoice rejection by the recipient

The rollout will occur in two stages:

- January 1, 2026: VAT-registered businesses must issue and receive e-invoices, while non-VAT entities are only required to be able to receive them

- January 1, 2027: All obligations apply to both VAT and non-VAT registered businesses

B2C E-Invoicing

While B2C obligations already existed in Croatia to some extent, the new regulation, also part of the Fiscalization Act 2.0 [↗︎], will broaden the scope so that every B2C transaction (invoices, receipts, …) and every form of payment (cash, card, …) falls under this requirement.

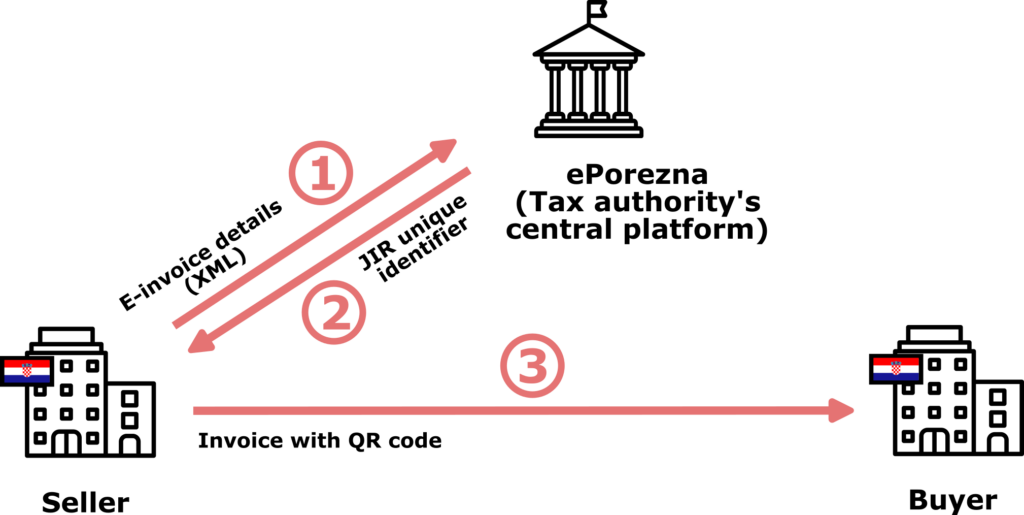

This B2C obligation essentially functions as a Clearance mandate for all B2C transactions, in a process called “Fiscalization“. Under this system, tax-related invoice data must first be submitted to the tax authority via ePorezna [↗︎] (eTax), the tax authority portal, in a proprietary XML format for validation.

Once approved, the administration sends back to the invoice issuer a unique identifier called JIR (Jedinstveni Identifikator Racuna) confirming that the invoice has been successfully validated, i.e. “cleared”.

The issuer is then responsible for including this identifier in the final invoice (typically as a QR code) before delivering it to the customer, most often as printed or PDF document.

This requirement applies to any type of software that generates B2C invoices, including both traditional invoicing solutions and cash register systems.

Unlike the B2G and B2B mandate, which will be implemented in two phases, the B2C obligation is in full effect immediately since January 1, 2026.

Timeline

B2G e-invoicing fully mandatory

E-invoicing to public administrations is mandatory countrywide through a solution offerred by FINA

Fiscalization Act 2.0 - Phase 1

B2G + B2B e-invoice sending & e-reporting become mandatory for all VAT-registered businesses, while B2C e-invoicing clearance & B2G + B2B e-invoice reception becomes mandatory for all businesses

Fiscalization Act 2.0 - Phase 2

All obligations (B2G + B2B e-invoicing & e-reporting, B2C e-invoicing clearance) become mandatory for all businesses countrywide

Latest E-Invoicing News in Croatia

E-invoicing in Croatia from January 1, 2026: The Complete Guide

Technical Details (B2G & B2B)

This section aims to describe the B2G & B2B e-invoicing requirements implemented since January 1, 2026, as mandated by the “Fiscalization Act 2.0”.

This process is called the “Fiscalization of e-invoices“.

E-invoice format

Invoice transmission for all public and private businesses must be done electronically, in an unified manner. It includes all the following types of transactions:

- B2G: Business-to-Government

- B2B: Business-to-Business

- G2B: Government-to-Business

- G2G: Government-to-Government

Invoices must be issued following the HR-CIUS XML format, which is compliant with the EN 16931.

Extensive e-invoice documentation [↗︎] is available, including e-invoices examples, schemas (XSD), schematrons and codelists. So far, only UBL documentation seems to have been published.

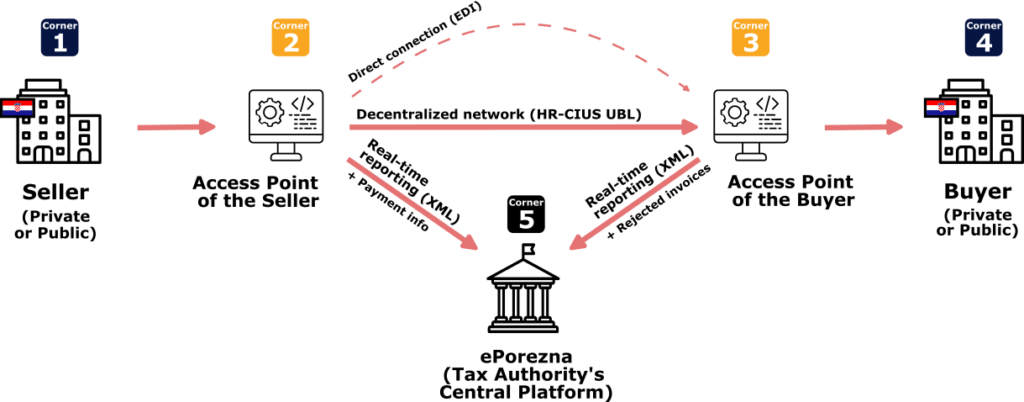

E-invoice delivery

Under the mandate, electronic invoices must be delivered through a decentralized network built locally and based on the EU’s eDelivery [↗︎] principles. In practice, this functions as a Croatian equivalent of the Peppol network, following the same core concepts such as Access Points, a business directory, and AS4 communication. This network must be adopted as the default solution by all companies.

Businesses can either establish and operate their own Access Point or use a certified service provider (details provided below).

Alternatively, electronic invoices can be exchanged through other methods, such as direct EDI connections between trading partners.

To ensure correct routing and delivery, each company must register their invoice reception address in the Croatian central business directory, called AMS. This registration must be completed on ePorezna [↗︎] (eTax), the official portal of the tax authority, or can be performed by the selected certified provider [↗︎].

"Fiscalization" - Real-time reporting

At the same time that the electronic invoice is being delivered to its recipient, a subset of the invoice’s tax data must also be extracted, digitally signed, and submitted to the tax authority portal, ePorezna. This process is known as the “Fiscalization” of an invoice.

Important: Fiscalization must be carried out by both the sender and the receiver of the invoice to enable the government to cross-check the accuracy of the reported data.

The Fiscalization message to be sent to the tax authority must be formatted in a proprietary XML format, and here again, extensive documentation [↗︎] is available, including examples, schemas, and technical specifications.

Among the information required in the Fiscalization message is the KPD code [↗︎] for each sold item. The KPD code comes from Croatia’s national classification system, which categorizes all goods and services by activity or product-service type.

Its purpose is to help the government monitor economic activity more effectively. Properly assigning KPD codes represents a significant task for companies, as they must ensure that each product or service is correctly classified according to this system.

"E-reporting" - Additional requirements

In addition, Croatian companies must comply with three further obligations, collectively referred to as “e-reporting”. These tasks are separate from the Fiscalization process, which is why they are distinguished under this term.

The three obligations involve sending e-reporting XML messages to the ePorezna central platform in the following cases:

- The invoice issuer must send tax data even for invoices that could not be delivered electronically, for example if the recipient has not registered an electronic address in the AMS central directory.

- The invoice issuer must report payment information for each invoice to the tax authority.

- The invoice receiver must notify the tax authority if they choose to reject an electronic invoice (no later than the 20th day of the month following the transaction).

Certified providers

Multiple e-invoicing solutions covering all aspects of the mandate are available on the market and have been certified by the Croatian tax authority. Their use is not mandatory, as companies can choose to develop their own access point or connect directly to the ePorezna platform.

However, if companies prefer to rely on an e-invoicing solution rather than managing their own access point and handling all Fiscalization and e-reporting obligations, they must select one of the certified providers.

Access the official list of Croatia certified e-invoicing service providers [↗︎].

Notably, FINA, the state entity that facilitated B2G e-invoicing in the country from 2019 to 2025, is one of the officially certified providers. This allows Croatian public entities to continue using FINA as their e-invoicing solution and receive electronic invoices in the same way they have since 2019.

Online tools

The FiskApplication can be used by any company to access a wide range of information, including an overview of their Fiscalization messages and their statuses, such as errors and rejected e-invoices. It also allows companies to perform key tasks, such as declaring their e-invoice reception address (and if applicable, their certified provider).

Alternatively, private businesses that are not VAT-registered can use the MICROeRACUN application to fulfill all their obligations, including declaring their reception address in the AMS and Fiscalizing e-invoices. They can use it through manual data entry to comply with the two phases of the mandate, i.e. receive e-invoices and perform the corresponding Fiscalization from January 1, 2026, and to send e-invoices from January 1, 2027.

Both applications can be accessed directly on the ePorezna portal [↗︎].

Technical Details (B2C)

This section aims to describe the B2C e-invoicing requirements that are already in place as part of “Fiscalization 1.0”, and that was extended to all types of B2C transactions since January 1, 2026.

This process is called the “Fiscalization of final consumption accounts“.

Invoice issuance & clearance

The Croatian B2C obligation essentially functions as a Clearance mandate.

This means that when issuing an invoice, companies must first send a subset of the invoice data in a proprietary XML format to the tax authority platform, ePorezna [↗︎], which validates, or “clears,” the invoice.

Once validated, the platform generates a unique identifier called JIR and returns it to the issuer, who must include it on the invoice or receipt. This is typically done by embedding a QR code on the document.

To meet this Clearance requirement, referred to as “Fiscalization” in Croatia, all companies must use B2C invoicing software capable of fully handling the Fiscalization process. This applies to all types of transactions and payments, including card and cash payments in stores, so even cash registers software is in scope.

Comprehensive technical B2C documentation [↗︎] is available to describe this Fiscalization process.

Invoice format & delivery

The Croatian mandate does not impose any specific electronic format or transmission method for B2C invoices or cash register receipts.

Businesses may continue issuing them as usual, most often as PDF or printed documents / receipts.

Once received, customers can use the JIR identifier or QR code shown on the invoice or receipt to verify that it is valid and has been properly cleared by the tax authority beforehand.

Additional requirements

In addition to using software and equipment capable of Fiscalization, companies must also comply with several procedural requirements:

- Determine and adopt an “internal act” defining the company’s key B2C invoicing processes, including invoice numbering methods, a list of business premises, and of labels assigned to each premise and payment terminal

- Register their business premises on the ePorezna [↗︎] tax administration portal

- Display a notice of information regarding Fiscalization within their premises

- Maintain a book of imported invoices to ensure invoice issuance can continue in case of payment terminal failure, or alternatively implement backup solutions that prevent interruption of service

The Invoicing Hub Word

Croatia

Croatia has introduced extensive invoicing obligations that covers all types of transactions: B2G, B2B, and B2C. The framework combines:

- “True” e-invoicing and tax data reporting for B2G and B2B transactions, aligned with market standards and the principles of the ViDA directive, including a decentralized five-corner model and an EN16931-compliant invoice format.

- A clearance model for B2C transactions, designed to encourage adoption by end consumers while ensuring the tax authority receives comprehensive transaction data.

However, the impact on businesses is significant. The Croatian tax authority has defined a wide range of requirements, including mandatory registration of business premises and classification of all products using the KPD taxonomy, while also choosing not to rely on the Peppol network. As a result, companies must invest additional effort to connect to the local infrastructure and comply with the mandate.

The implementation timeline is also very tight: the law was passed on June 13, 2025, with the first phase began on January 1, 2026.

The start of 2026 will be critical in determining the success of this “Fiscalization Act 2.0,” which otherwise appears to be a well-designed and well-documented mandate.

Additional Resources [↗︎]

Tax authority supervising e-invoicing in Croatia

Official e-invoicing homepage & resources

Official explanations & technical resources about B2G & B2B requirements

Official explanations & technical resources about B2C requirements

List of certified providers for B2G, B2B and B2C requirements in Croatia

List of questions & answers about the B2G, B2B and B2C obligations in Croatia

Official comparison of B2G & B2B obligations vs. B2C obligations

Get your Project Implemented

Gold Sponsor

Silver Sponsors

Latest News

E-invoicing webinar series to support businesses in New Zealand

E-Invoicing Exchange Summit Middle East 2026 (Dubai, Mar. 30 – Apr. 1)

France’s DGFiP unveils the official list of Approved Platforms

Additional transactions covered by Israel’s e-invoicing mandate in 2026

Denmark’s Bookkeeping Act final stage and cancellation of OIOUBL 3.0

📩 Newsletter

Receive the latest e-invoicing news, directly in your mailbox, once a month.