E-Invoicing in Poland

Last update: 2026, February 11

Summary

B2G

Partially mandatory

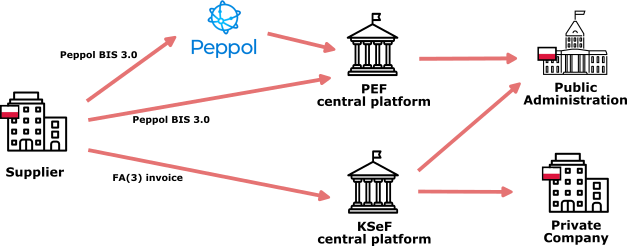

All Polish public administrations accept electronic invoices, and e-invoicing is even mandatory for large suppliers through the “PEF” central platform (using Peppol BIS 3.0 or a Polish variant), or through the “KSeF” central platform (using the “FA(3)” (XML) format).

B2B

Partially mandatory

E-Invoicing is mandatory for large companies through the “KSeF” central platform using the “FA(3)” (XML) format, and all companies must be able to receive e-invoices.

B2C

Not mandatory

E-Invoicing is possible through the “KSeF” central platform using the “FA(3)” (XML) format, but PDF or paper will remain allowed.

What the Law Says

B2G E-Invoicing

Since 2019, it is mandatory for all Polish public administrations to accept electronic invoices but issuance wasn’t mandatory making it possible to issue paper or PDF invoices, as long as a complete audit trail was ensured.

However, with the implementation of the B2B e-invoicing mandate in 2026, following several delays, B2G e-invoicing is now fully mandatory for all B2G transactions in Poland.

The roll-out consists of 3 phases, depending on company annual turnover:

- February 1, 2026:

- Reception of e-invoices mandatory for all companies

- Sending of e-invoices mandatory for large taxpayers (PLN 200M+ / ~47M€ turnover in 2024)

- April 1, 2026: Sending of e-invoices mandatory for medium & small companies

- January 2027: Sending of e-invoices mandatory for micro-businesses (invoices under PLN 450 / ~106€ and sales under PLN 10,000 / ~2364€ per month), cash register integration, and mandatory use of KSeF invoice numbers

Until February 2026, issuance and reception of voluntary B2G e-invoices was to be done through the “PEF” central platform in plain Peppol BIS 3.0 UBL format or a Polish extended “Faktura specjalizowana” variant. The PEF platform is also connected directly to the Peppol network.

Incidentally, a new central platform called “KSeF” is now available in addition to the PEF platform. All invoices going through the KSeF platform have to be issued in a new XML format called “FA(3)“.

It means that suppliers of the public administrations, which must issue B2G e-invoices, have the choice between the PEF platform in Peppol BIS 3.0 format or the KSeF platform in FA(3) format.

Invoices must be archived for 5 years in most cases.

B2B E-Invoicing

From 2026 onward, electronic invoicing will be mandatory for all domestic B2B transactions in Poland:

- Companies with an annual turnover above 200M PNL will have to comply from February 1, 2026

- All other companies (excluding micro-businesses) will follow starting from April 1, 2026

- Micro-businesses (invoices under PLN 450 / ~106€ and sales under PLN 10,000 / ~2364€ per month) will have until January 1, 2027 to comply

E-Invoices will have to be sent in the XML “FA(3)” format through the new “KSeF” central platform and all other formats & transmission methods will not be accepted anymore. It is also not possible to use the PEF platform for B2B transactions.

There will also be a grace period until the end of 2026 where no sanctions will be issued, allowing more time to companies to fully comply with the mandate.

Finally, after some back & forth from the tax authority, it seems that B2C transactions will be possible via the KSeF platform, but not mandatory: paper or PDF will remain allowed for those.

Invoices must be archived for 5 years in most cases.

Timeline

B2G E-Invoicing - Mandatory Acceptance

B2B E-Invoicing Mandate - Phase 1

B2B E-Invoicing Mandate - Phase 2

End of the B2B mandate grace period

B2B E-Invoicing Mandate - Phase 3

Latest E-Invoicing News in Poland

Webinar – European E-Invoicing Spotlight: Greece, Poland, Croatia & Spain

Understanding Poland’s 2026 B2B e-invoicing requirement

Overview of E-invoicing in Poland

Domestic transactions

From 2026 onwards, all Polish invoice receivers (B2G and B2B) will be reachable through the KSeF platform, although suppliers retain the choice to keep using the PEF platform to reach their B2G recipients if they prefer so.

International transactions

For non-domestic transactions, Polish sellers must also issue the invoice via KSeF, like any domestic B2B transaction.

However, because the non-established customer isn’t concerned by the mandate, the Polish seller might additionally send a “copy” to the buyer for their records, in the format of their choice (paper, PDF or electronic through the Peppol network for example.

Technical Details - PEF platform (B2G only)

Since 2019, when sending electronic invoices to public administrations, businesses can use the PEF platform (Platforma Elektronicznego Fakturowania).

They have to send invoices in PEPPOL BIS 3.0 format (based on UBL XML) or using a BIS 3.0-UBL extension called “Faktura specjalizowana“, which adds specific fields for domestic Polish invoicing (e.g. for utility statements, addition gross data or supporting invoice factoring). All public administrations are required to accept e-invoices these ways.

Contrary to KSeF platform, the PEF platform is designed not only to handle invoices, but also other documents, such as delivery advice, acknowledgment of receipt or accounting note, among others.

Finally, the platform is connected to the Peppol network, facilitating adoption and increasing interoperability particularly for cross-border invoices.

Since February 2026, companies can also opt for using the KSeF platform instead, as described below.

Technical Details - KSeF Platform (B2G + B2B)

Mandatory Platform & Format

Starting in 2026, electronic invoicing will become mandatory for all B2B transactions through a new platform called KSeF (Krajowy System e-Faktur). It will use a dedicated Poland-specific format known as FA(3). This format is XML-based, and even though it respects the EN 16931 semantic data model & principles, it is unfortunately not fully compliant with the EN 16931 standard, preventing more global interoperability.

Connection to the KSeF platform will be possible via API. Additionally, free tools have also been provided to help small businesses comply with the mandate more easily, including the option to submit invoices manually through direct input on the platform.

The KSeF platform will serve both invoice issuers, who will use it to send their invoices, and invoice recipients, who will use it to receive them. For every invoice it validates, KSeF assigns an official invoice number, which functions as a unique invoice identifier.

This setup follows a Centralized Exchange model, similar to the system already in place in Italy.

QR verification codes

All B2B invoices in the country will have to be exchanged through the KSeF platform in a structured electronic format. However, there may be situations where invoices are also shared in a non-electronic form, such as PDF or paper copies, for example in the context of cross-border transactions.

In these cases, the documents must include a QR verification code that enables the recipient to confirm on the KSeF platform that the invoice was properly validated, ensuring its authenticity.

KSeF Offline Mode

In principle, suppliers should issue invoices directly to the KSeF platform in real time, a process known as “Online Mode”.

However, certain situations such as system outages or scheduled maintenance may prevent this. In such cases, suppliers can issue invoices to their customers outside KSeF, in what is called the “Offline Mode”. They must then submit the invoice to KSeF no later than the following business day to obtain the official KSeF invoice number.

Invoices sent in Offline Mode include two QR codes: an “OFFLINE” QR code, which allows the recipient to verify the invoice on KSeF once the supplier has uploaded it, and a “CERTIFICATE” QR code, which confirms the supplier’s identity.

Invoice attachments

Invoice attachments are supported by the KSeF platform, and can be transmitted with the e-invoice but the mandatory invoice data must be present directly in the XML. The attachment aims only for a supplier to share additional business information to the customer.

Companies are required to submit a notification through the e-Tax Office notifying their intention to issue and transmit attachment.

Additional Benefits

Outside the usual benefits of electronic invoicing (automation, efficiency, compliance, …), the Polish finance authorities offer specific incentives to increase usage of the KSeF platform specifically, such as:

- 10-years invoice archiving by the KSeF platform (businesses don’t need to archive the invoices themselves anymore)

- Automated invoice e-reporting to the tax authority (SAF-T process not necessary anymore)

- Tax incentives in some cases (for example quicker VAT refunds) until the e-invoicing mandate officially enters into force

The Invoicing Hub Word

Poland

Poland is currently facing significant VAT gaps, and mandatory e-invoicing will serve as a crucial tool in fighting this issue

Although the chosen model of one central platform “KSeF” (two if you count the legacy “PEF” B2G platform) and one standard format “FA(3)” makes the implementation of e-invoicing relatively straightforward for Polish companies, the language barrier can prove a challenge for multinational companies and for service providers wishing to offer e-invoicing services in Poland.

The shifting implementation timeline has added pressure for affected companies, but the 2026 deadline is now reached. In the meantime, the KSeF platform has undergone multiple improvements following extensive public consultations, which proved highly valuable.

However, the fact that the FA(3) format does not fully comply with the European Norm 16931, and similarly that the Centralized Exchange model that will be implemented does not comply with the ViDA directive, raises questions. These choices may lead to future work and burden for companies in order to remain compliant with the European Directives on e-invoicing.

Additional Resources

Public entity supervising the e-invoicing mandate in Poland

Homepage of the KSeF central platform

Official guidelines & resources on the use of the KSeF central platform

Explanations about the main topics of the B2B mandate

Technical specifications for the KSeF central platform

Technical specifications of the Polish FA(3) format to be used on the KSeF central platform

Homepage of the PEF platform used for B2G transactions in Poland

Get your Project Implemented

Gold Sponsor

Powered by the world’s most sophisticated invoice-centric AI – trained on over 2 billion invoices – Basware's Intelligent Automation drives ROI by transforming finance operations. We serve 6,500+ customers globally and are trusted by industry leaders including DHL, Heineken and Sony. Fueled by 40 years of specialized expertise with $10+ trillion in total spend handled, we are pioneering the next era of finance.

With Basware, now it all just happens.

Silver Sponsors

Advertisement

Latest News

Sweden to assess implementation of domestic e-invoicing

Webinar – France’s digital leap: preparing for mandatory e‑invoicing in 2026

Staying ahead of global e-invoicing mandates in 2026

KSeF 2.0 launched on February 1, 2026 in Poland

E-invoicing webinar series to support businesses in New Zealand

📩 Newsletter

Receive the latest e-invoicing news, directly in your mailbox, once a month.