E-Invoicing in the United Arab Emirates (UAE)

Last update: 2026, February 9

Summary

B2G & B2B

Will become mandatory soon

E-invoicing will progressively become mandatory in 2027 through the 5-corner model relying on the Peppol network and Accredited Service Providers.

B2C

Not mandatory

B2C transactions are not in the scope of the upcoming e-invoicing mandate and PDF or paper invoicing remains allowed.

What the Law Says

B2G & B2B E-Invoicing

The UAE e-invoicing legal framework is set out primarily through Ministerial Decision No. 243 of 2025 [↗︎] which describes the scope, obligations, exclusions and key operational requirements to be implemented, and Ministerial Decision No. 244 of 2025 [↗︎] which sets out the mandate timeline, from the pilot project to the phased implementation.

The mandate is driven by the UAE Ministry of Finance (MoF), and applies to almost all entities conducting business in the UAE and all public administrations. It covers all VAT-liable transactions subject to VAT, except those taxed at a zero rate.

2 major steps are required to fully comply with the mandate:

- Appointment of an Accredited Service Provider (ASP) and the ability to receive e-invoices:

- Large businesses (revenue > 50M AED / ~11,5M€): July 31, 2026

- Smaller businesses and government entities: March 31, 2027

- Mandatory e-invoicing via the Peppol network in the PINT-AE format:

- Large businesses (revenue > 50M AED / ~11,5M€): January 1, 2027

- Smaller businesses: July 1, 2027

- Government entities: October 1, 2027

Timeline

E-invoicing mandate pilot phase

Pilot program starts with selected taxpayers, and voluntary implementation becomes possible

Large businesses - Accredited Service Provider appointment

Large businesses (annual revenue > 50M AED / ~11,5 M€) must have appointed an Aaccredited Service Provider and be able to start receiving e-invoices by this date

Large businesses - Mandatory e-invoicing

Sending e-invoices becomes mandatory for large businesses

Smaller businesses & Government entities - Accredited Service Provider appointment

Smaller businesses & public administrations must have appointed an Aaccredited Service Provider and be able to receive e-invoices by this date

Smaller businesses - Mandatory e-invoicing

Sending e-invoices becomes mandatory for other businesses

Government entities - Mandatory e-invoicing

Sending e-invoices becomes mandatory for all public administrations countrywide

Latest E-Invoicing News in the UAE

Technical Details

Model and transmission method

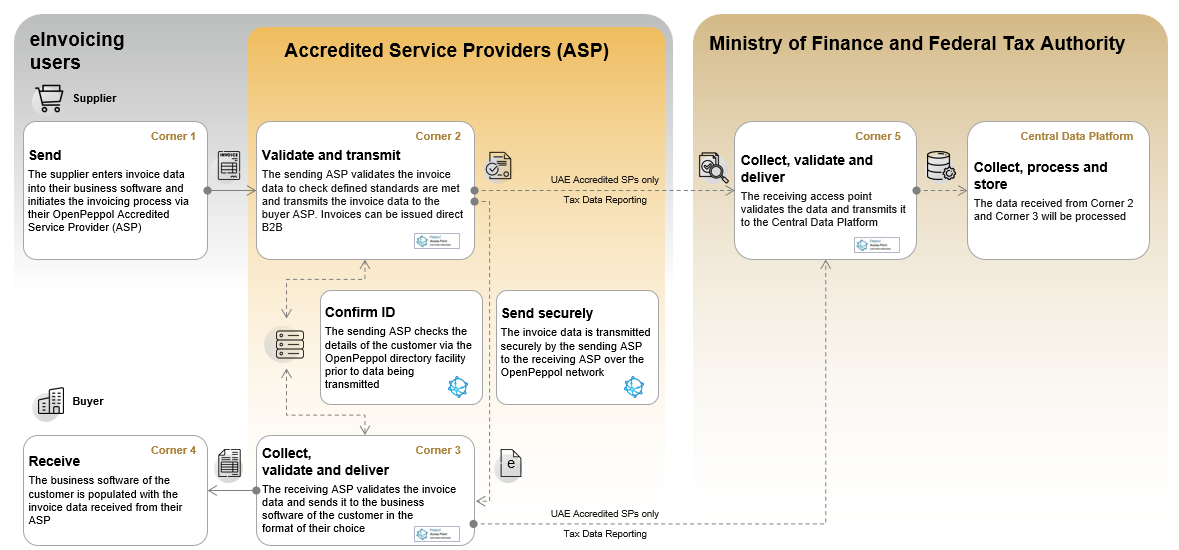

UAE is implementing an e-invoicing Decentralized Continuous Transaction Control and Exchange (DCTCE) model, widely known as the “5-corner model”.

The model relies on the Peppol network, with the UAE Ministry of Finance acting as the 5th corner of the model.

Under this framework, suppliers and buyers exchange electronic invoices via Accredited Service Providers (ASP), which both extract tax-relevant data and transmit it to the tax authority in real-time, allowing it to gain a nationwide, consolidated view of transactions.

Invoice format & Company identifiers

E-invoices must be issued in the PINT-AE format (technical specifications [↗︎]), the UAE-specific implementation of the Peppol INTernational (PINT) standard.

The Ministry of Finance has also published detailed guidelines and invoice schemes [↗︎] corresponding to the UAE standard tax invoice, as well as 15 use cases that correspond to specific invoicing situations, such as exports or self-billing.

The national tax identifier in use in the UAE is the Tax Identification Number (TIN) which is the first 10 digits of the Tax registration number (TRN) issued to the business. It must be used to address e-invoices via the Peppol network using the 0235 UAE Peppol ID.

Formal acknowledgements

To ensure successful e-invoice transmission and cross-validation of the data submitted by each ASP to the tax authority, multiple acknowledgements (positive or negative) must be sent between participants, using the Peppol MLS (Message Level Status) standard:

- The receiving ASP (corner 3) must send a MLS to the sending ASP (corner 2) upon validation of the invoice

- The tax authority (corner 5) will send a MLS to each ASP following the submission of the reported tax data

Accredited Service Providers

Exchanging e-invoices on the Peppol network usually relies on Access Points: e-invoicing service providers that are members of and are connected to the Peppol network.

However, in UAE, as in multiple other countries, the local Peppol Authority (here: the UAE Ministry of Finance) requires those Peppol Access Points to be officially accredited.

The UAE Ministry of Finance has set several key requirements to certify service providers, such as the ISO 22301 and 27001 certifications, the use of Multi-Factor Authentication (MFA), data encryption.

The UAE makes available the full set of requirements to become accredited [↗︎], as well as the full list of Accredited Service Providers [↗︎] (regularly updated).

The Invoicing Hub Word

United Arab Emirates (UAE)

The UAE, much like its iconic cities such as Dubai and Abu Dhabi, is leading the way in e-invoicing in the Middle East.

Adopting a pragmatic approach, the UAE has chosen to rely heavily on the Peppol standard, implementing a DCTCE e-invoicing mandate, also known as the 5-corner model.

However, the UAE has gone beyond merely adopting the standard. First, it requires mandatory accreditation for local Peppol Access Points, which are referred to locally as Accredited Service Providers (ASPs).

In addition, the UAE tax authority performs dual validation of tax-related data extracted from invoices. Both the sending ASP (corner 2) and the receiving ASP (corner 3) must independently extract the required data from the e-invoice and report it to the tax authority, which then cross-validates the information.

Finally, the system will also rely on the Peppol Message Level Status (MLS) standard to broadcast acknowledgements of successful or failed transactions, ensuring accurate information sharing among all participants.

Overall, the UAE’s choice to use the Peppol network and the PINT invoice format will significantly simplify implementation for companies operating internationally, by leveraging a widely proven and established standard.

Additional Resources [↗︎]

Tax authority supervising e-invoicing in the United Arab Emirates (UAE)

Official e-invoicing mandate homepage and resources

Guidelines, schemas and invoice mandatory fields

Official list of UAE pre-approved Accredited Service Providers

Technical specifications of the UAE implementation of the Peppol INTernational (PINT) invoice format

Get your Project Implemented

Gold Sponsor

Powered by RTC Suite's platform, our cloud-based e‑invoicing solution integrates seamlessly with any ERP system, enabling both local and global organizations to automate, validate, and submit fully compliant e‑invoices and tax documents across the UAE and the wider region.

Combining deep regulatory expertise with enterprise‑grade technology, we deliver secure and scalable solutions that ensure 100% compliance with locally hosted data in the UAE.

Silver Sponsors

Advertisement

Latest News

KSeF 2.0 launched on February 1, 2026 in Poland

E-invoicing webinar series to support businesses in New Zealand

E-Invoicing Exchange Summit Middle East 2026 (Dubai, Mar. 30 – Apr. 1)

France’s DGFiP unveils the official list of Approved Platforms

Additional transactions covered by Israel’s e-invoicing mandate in 2026

📩 Newsletter

Receive the latest e-invoicing news, directly in your mailbox, once a month.