E-Invoicing in Belgium

Last update: 2026, January 5

Summary

B2G

Mandatory

B2G invoice acceptance by public entities is mandatory since 2019.

All Suppliers are required to issue electronic invoices, with very few exceptions.

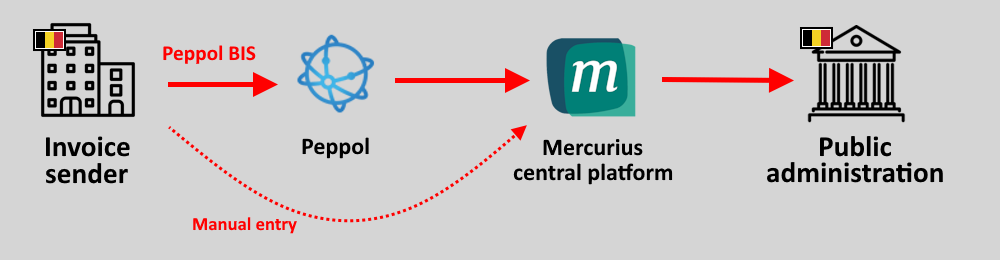

Public infrastructure is based on the “Mercurius” platform and the Peppol network.

B2B

Mandatory

E-invoicing is mandatory country-wide since 1.1.2026, primarily through the Peppol network.

E-Reporting

Not mandatory yet, will become mandatory in 2028.

E-Reporting will become mandatory country-wide starting 2028, relying on the Peppol 5-corner model.

What the Law Says

B2G E-Invoicing

All Belgian public authorities accept electronic invoices since 2019.

All suppliers are now required to issue electronic invoices, following a phased roll-out that took place starting from 2022. For contracting authorities in the Brussels region, the supplier mandate started in November 2020.

But e-invoicing is not mandatory in all cases: old tenders dating from before the deadlines, or new tenders below 3,000 €, as well as some tenders from specific public companies such as VRT, SNCB or bpost remained exempted from obligatory e-invoicing.

When e-invoicing is possible and/or mandatory, public infrastructure is based on the “Mercurius” platform and the Peppol network.

Suppliers are encouraged to use Peppol BIS 3.0 invoices using the CBE as identifiers. Alternatively, manual invoice creation is available, too. The Mercurius platform allows to keep track of submitted invoices.

B2B E-Invoicing

Electronic B2B invoicing is mandatory countrywide since 1.1.2026, following a law voted by the parliament at the beginning of 2024, and the corresponding royal decree issued in 2025.

It relies mainly on the Peppol network and the Peppol BIS 3.0 format. However, if both parties agree, they can instead opt to use any other EN16931-compliant format, and the delivery method of their preferrence.

A 3-month grace period is planned until March 31, 2026, during which no penalties will apply, providing extra time for companies to complete their solution implementation.

E-Reporting

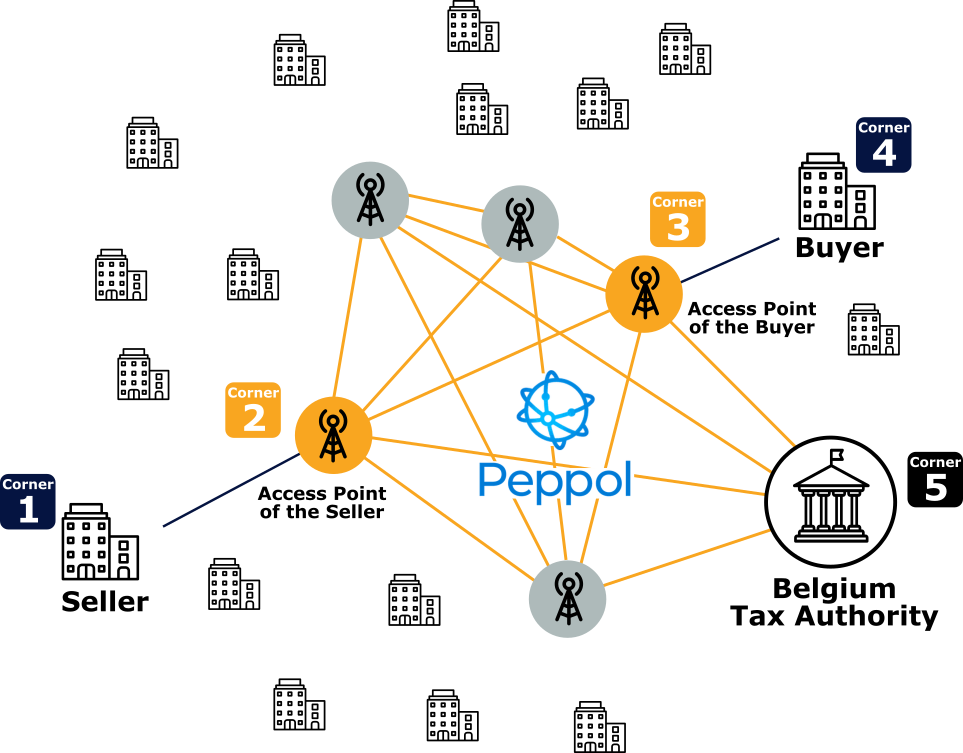

E-reporting is set to become mandatory in Belgium, following the same framework as the 2026 B2B e-invoicing mandate.

Although detailed specifications are yet to be published, the future e-reporting regulation aims to introduce a fifth corner (the tax authority) into the Peppol network’s four-corner model, which will be used for the e-invoicing mandate. The mandate should cover B2B & B2C transactions, including those conducted via fiscal cash registers.

Moreover, the system is designed in line with the European Commission’s VIDA initiative, ensuring the upcoming e-reporting mandate aligns with future EU regulatory developments.

Timeline

B2G E-Invoicing Mandate - Mandatory Acceptance

Public authorities are required to accept electronic invoices.

B2G E-Invoicing Mandate

All suppliers of public administrations are required to issue electronic invoices.

B2B E-Invoicing Mandate

Electronic B2B invoicing is now mandatory countrywide.

E-Reporting Mandate

E-reporting will become mandatory, with the tax authority becoming the 5th corner in the framework implemented with the 2026 e-invoicing mandate.

Latest E-Invoicing News in Belgium

Latest provisions and technical challenges for the imminent Belgium mandate

E-invoicing in Belgium will start with a 3-month grace period

Technical Details (B2G)

Identification

All public purchasing entities are registered in the “Crossroads Bank for Enterprises” (CBE) the same as private economic operators. This registry assigns a 10-digit “Enterprise Number” used to identify the issuer and recipient of the invoice. Alternatively, the VAT number (comprised of country code “BE” plus the Enterprise Number) is also possible. The registry is publicly available to find the required Enterprise Number if not given in the ordering process.

Invoice Content and Format

Belgium invoice content is required to comply to the European Norm (EN) 16931 created for Directive 2014/55/EU.

As a technical format, Belgium uses the Peppol BIS 3.0 Invoice format as a standard.

Implementation

B2G electronic invoices are centrally handled in the “Mercurius” platform.

Private companies can submit invoices through:

- use of the Peppol network (preferred)

- or manual data entry

Mercurius also allows to track delivery of the invoice to the final recipient in the public administration. Senders can register and identify using their electronic identification card (“eID”).

Within the public administration, Mercurius is available as an “invoice inbox” listing inbound invoices and can be integrated with the internal accounting systems of the contracting agencies.

Technical Details (B2B e-invoicing)

Since January 1, 2026, Belgian businesses are required to exchange all B2B invoices electronically in compliance with the EN 16931 standard.

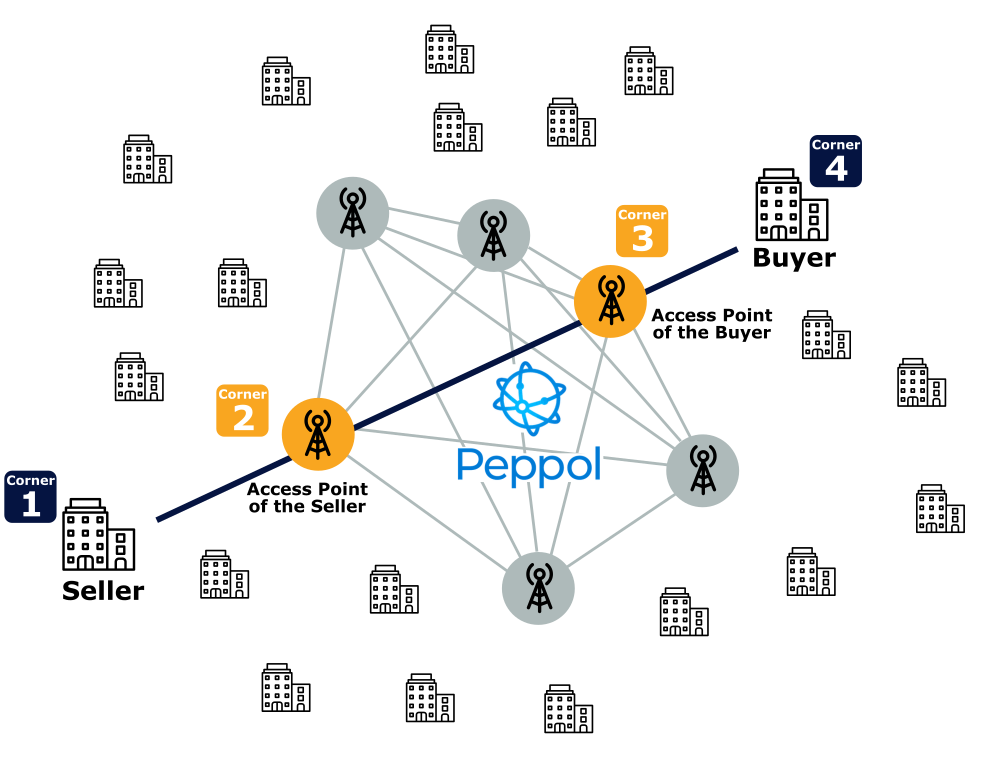

The default method, strongly recommended by the Belgian Ministry of Finance and mandatory for all Belgian companies to support, will use the Peppol network with the Peppol BIS 3.0 format.

All companies must use Peppol access points to ensure full interoperability across the country and internationally, allowing any Belgian business to send electronic invoices to any other Belgian business seamlessly.

An indicative list of 350+ e-invoicing software providers is available. This list is purely informative: businesses are free to use a listed provider, choose another, or build their own Peppol connection.

Invoice delivery to the intended recipient will continue to rely on identification via the Enterprise Number or VAT Number.

As an alternative, businesses may also use other formats, as long as they comply with EN 16931, and delivery methods provided there is mutual agreement between the sender and the receiver.

Upcoming E-Reporting Mandate (2028)

Although the law introducing the e-reporting mandate has not yet been enacted and all details are still pending, it has already been indicated that Belgium’s upcoming e-reporting requirement will be based on a “five-corner” configuration within the Peppol network, from January 1, 2028 onwards.

In this setup, which aligns with the ViDA directive and the DCTCE (“Decentralized Continuous Transaction Controls and Exchange”) model, the Belgian tax authority will serve as the network’s fifth corner. Under this model, companies will be required to transmit VAT data extracted from their invoices to the tax authority in real time.

This approach is a direct extension of the 2026 e-invoicing mandate. The necessary dual transmission of e-invoices to both the intended recipient (the buyer) and the government will be handled seamlessly through the companies’ Peppol access points.

Further details are expected to be released, likely in 2026.

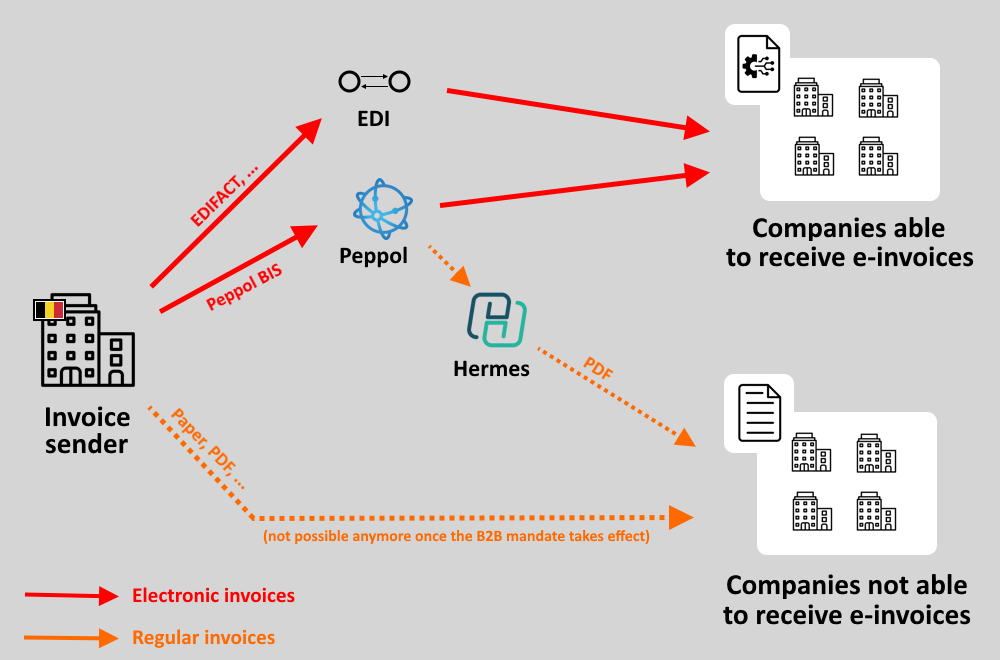

Previous B2B situation (deprecated)

Until the end of 2025, any transmission channel for domestic invoices between private companies was allowed in mutually agreed formats including

- Paper-based invoices, (unstructured) PDF

- EDIFACT– and XML-based formats as long as they can be made humanly readable upon audit

The Hermes Platform to Facilitate E-Invoicing Adoption

To help in initial e-invoicing adoption, a public default delivery system named “Hermes” was provided free of charge. Hermes automatically registered all Belgian companies’ CBE Enteprise Numbers for free as receivers in the Peppol network. Therefore, Hermes acted as the default “receiver” in the Peppol network, so any Peppol sender could use its infrastructure.

Hermes generated a human-readable rendition of the XML-format invoice and used an e-mail address from a specific invoice field to deliver the XML and PDF as an E-Mail. The receiver could then import the invoice into its accounting system or process it manually, if not possible in another way.

The Hermes Service was decommissioned ahead of the 2026 e-invoicing mandate because, while it provided a useful temporary solution, it automatically registered all Belgian companies as Peppol receivers, effectively locking them into Hermes and making it difficult to switch providers.

Shutting it down released these default registrations, allowing companies to freely re-register on the Peppol network with their own chosen, compliant e-invoicing service provider.

The Invoicing Hub Word

Belgium

Belgium B2G is consistently based on international standards, starting with B2G transactions with Mercurius:

- Extending accessibilty offering manual invoice data entry, particularly to SMEs

- Improving trust through transparency about invoice delivery progress

For B2B transactions, the strategy continues to prioritize the use of plain standards by default, with the Peppol network serving as the cornerstone of the model.

These choices are intended to ease implementation for all companies countrywide, while also paving the way for the upcoming e-reporting obligations scheduled for 2028 in Belgium and 2030 under ViDA across the European Union.

They should also significantly reduce maintenance and evolution costs, making this architecture, at least on paper, a highly promising model that could be replicated by other countries.

That said, only time will reveal whether all aspects have been adequately addressed, or whether gaps will emerge that require further adjustments.

Additional Resources

Public entity supervising the e-invoicing mandates in Belgium

E-invoicing homepage & resources on the BOSA website

Official FAQ about e-invoicing in Belgium

Belgium B2G central platform

Educational website about e-invoicing in Belgium, managed by BOSA

Entire set of official Peppol BIS 3.0 specifications

Get your Project Implemented

Gold Sponsor

Billit is a certified Peppol Access Point, EU certified open banking (AISP) provider enabling secure e-invoicing across Europe and beyond. The platform currently supports 120,000 users (Q1 2025) who process more than 2 million invoices monthly. It also offers a free portal for accountants, enhancing collaboration with clients.

With offices in Ghent, Brussels, Sint-Niklaas, and Hamburg, Billit is a trusted partner in digital transformation.

Silver Sponsors

Advertisement

Latest News

Peppol G2 to G3 certificate migration on April 1st 2026

E-Invoicing Compliance in the UAE: The Complete Guide

Sweden to assess implementation of domestic e-invoicing

Webinar – France’s digital leap: preparing for mandatory e‑invoicing in 2026

Staying ahead of global e-invoicing mandates in 2026

📩 Newsletter

Receive the latest e-invoicing news, directly in your mailbox, once a month.