E-Invoicing in Portugal

Last update: 2025, December 3

Summary

B2G

Mandatory

Mandatory in CIUS-PT XML format.

B2B

Not mandatory

Currently allowed using EDI or any other medium as long as a complete business audit trail is guaranteed.

Non-electronic invoices (including PDF) must contain a QR code (generated by a certified software), and starting from January 1st, 2027, a Qualified Electronic Signature (QES).

What the Law Says

B2G E-Invoicing

Portugal has started mandating electronic invoicing for the public sector in 2019, but those plans have been thwarted by Covid and they experienced successive delays.

Still, it is now mandatory for all companies throughout the country, as small & medium suppliers have been included to the mandate since January 1st, 2025, as specified by the latest legislative decree of 23.12.2023.

Only 2 electronic invoicing formats are allowed: the UBL “CIUS-PT” and the CEFACT CII XML “CIUS-PT”. Both are based on XML and are compliant with the European Norm (EN) 16931.

Additionally, the mandate says nothing about how to transmit the e-invoices. There is a central platform called “FE-AP” (Fatura Eletrónica na Administração Pública) that accepts CIUS-PT electronic invoices, but not all public recipients are available on this platform. For public recipients unreachable through that platform, another solution must be discussed by both parties (such as EDI, manual upload, email, …).

Invoices must be archived for 10 years.

B2B E-Invoicing

There is no B2B e-invoicing mandate in place in Portugal. Private business are free to choose the invoice format they prefer in the following list, as long as it is mutually agreed by both parties:

- Paper-based invoices, with a specific QR code (generated by a certified solution)

- PDF invoices, again with a specific QR code and, starting from January 1, 2027 with a Qualified Electronic Signature (QES), although this latter requirement keeps being delayed year after year.

- EDI invoices

Timeline

E-Invoicing Accepted by All Public Administrations

All central & local administrations in Portugal are able to receive electronic invoices.

B2G E-Invoicing Mandatory for Large Suppliers

Large enterprises (> 250 employees) must send electronic invoices to Portuguese public administrations in CIUS-PT format (UBL or CII)

QR Code Mandatory for Paper & PDF Invoices

All paper & PDF invoices must include a QR code generated by a certified software.

B2G Mandatory

If there is no further delay, the B2G mandate will take effect for SMEs, making electronic invoicing mandatory for all suppliers of the public sector.

Mandatory QES for B2B

PDF invoices remain allowed for B2B transactions but will require a Qualified Electronic Signature.

Latest E-Invoicing News in Portugal

E-Invoicing named key enabler in EU’s Single Market Strategy

ViDA formally published

Technical Details (B2G)

The B2G e-invoicing situation in Portugal is relatively straightforward: all invoices must be exchanged electronically in CIUS-PT format.

E-Invoice Formats

The content of “real” structured electronic invoices for Portugal is defined in a specification called CIUS-PT. The CIUS-PT is a Portuguese adaption of the European Norm (EN) 16931. The invoice content can be written in 2 XML formats: the OASIS UBL CIUS-PT, and the CEFACT CII CIUS-PT.

On a voluntary basis, a document identification number called ATCUD can also be added to all invoices thanks to a certified software. There were discussions to make it an official requirement for all invoices country-wide, but in the end it will remain optional.

E-Invoice Transmission

A central platform called FE-AP (Fatura Eletrónica na Administração Pública) was built by the eSPap (Entidade de Serviços Partilhados da Administração Pública), an official entity of the government, and all public administrations country-wide can use this platform to receive their invoices.

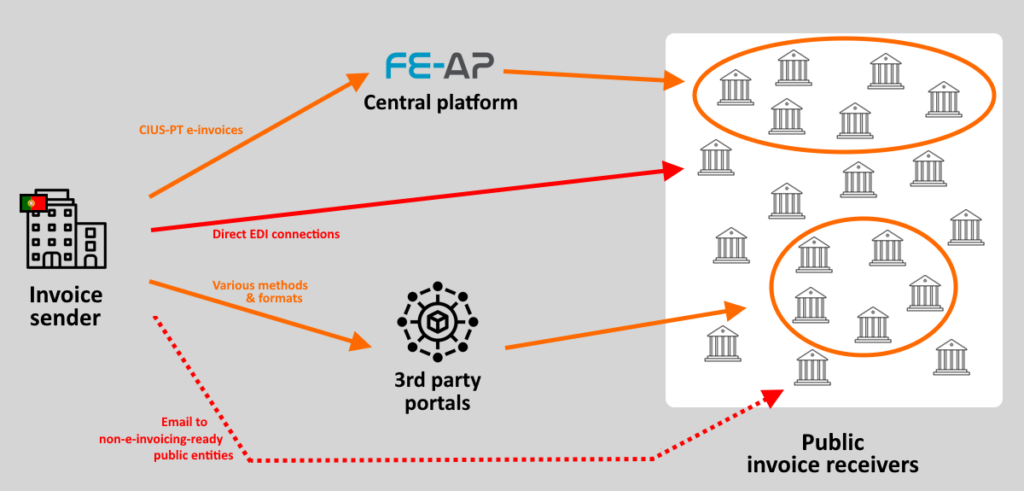

But the use of the FE-AP platform is not mandatory, which leads to a very complex B2G e-invoicing landscape. Each public entity may have different transmission requirements, and the best way to figure it out is to check the list of public entities reachable via the FE-AP portal maintained by the eSPap. If a public entity is missing from the list, it’s up to the supplier to initiate contact with it and to ask how the e-invoices should be transmitted.

The following methods are currently in use in Portugal:

- FE-AP central platform: Suppliers can send their CIUS-PT e-invoices to the FE-AP platform using WebServices or AS2. But the FE-AP onboarding process can prove tedious: each new supplier must get in touch with the eSPap, fill forms and run tests before being allowed to use the platform. Alternatively, small suppliers (that issue less than 250 invoices per year) can manually upload their invoice on the FE-AP Microportal.

- 3rd party portals: Many public entities have contracted with service providers that have built their own portals, and may offer various transmission capabilities (from manual upload to EDI) to suppliers of those public entities, but often at a cost for the supplier.

- Direct EDI connection: Some public entities will require their suppliers to send their e-invoices using a bilaterally configured, direct connection.

- Email: For non-EDI-ready public entities, suppliers may also be asked to send their CIUS-PT e-invoice by email.

The Invoicing Hub Word

Portugal

The B2G E-Invoicing mandate in Portugal was set to be relatively straightforward: all invoices must be sent electronically to public administrations via a central platform.

However, implementation faced numerous complications and delays, partly due to Covid and partly due to the slow e-invoicing adoption of public administrations and private companies. The four-year delay in implementing the B2G mandate for SMEs and the current six-year delay for mandatory QES on PDF invoices are concerning.

This results in a relatively clear situation regarding B2G formats (only CIUS-PT and temporarily PDF are allowed), while the topic of e-invoicing transmission methods is much more complex. Indeed, the central platform FE-AP is not mandatory for public entities, and those are free to choose other solutions, leading to a proliferation of point-to-point EDI connections or even having to resort to emails.

All this put together with also the mandatory QR code and the optional ATCUD both requiring certified software makes it complicated to do e-invoicing in Portugal. Getting help from a well-established service provider is highly recommended and sometimes even the only viable choice.

On the other side, the lack of B2B e-invoicing mandate means that most companies are not impacted in their daily operations, but of course still miss out on the benefits of e-invoicing.

Additional Resources

Public entity supervising the e-invoicing mandates in Portugal

E-invoicing homepage & resources on the eSPap website

FE-AP platform homepage

List maintained by the eSPap

Technical specifications for the Portuguese CIUS-PT format

Get your Project Implemented

Gold Sponsor

Silver Sponsors

Latest News

E-invoicing webinar series to support businesses in New Zealand

E-Invoicing Exchange Summit Middle East 2026 (Dubai, Mar. 30 – Apr. 1)

France’s DGFiP unveils the official list of Approved Platforms

Additional transactions covered by Israel’s e-invoicing mandate in 2026

Denmark’s Bookkeeping Act final stage and cancellation of OIOUBL 3.0

📩 Newsletter

Receive the latest e-invoicing news, directly in your mailbox, once a month.