Alternatively, the SAT offers free tools that enable invoice issuers to generate their invoices and submit them directly to the SAT for validation, either through manual data entry or by using OCR via a mobile app.

E-Invoicing in Mexico

Last update: 2025, June 6

Summary

B2G, B2B, B2C

Mandatory

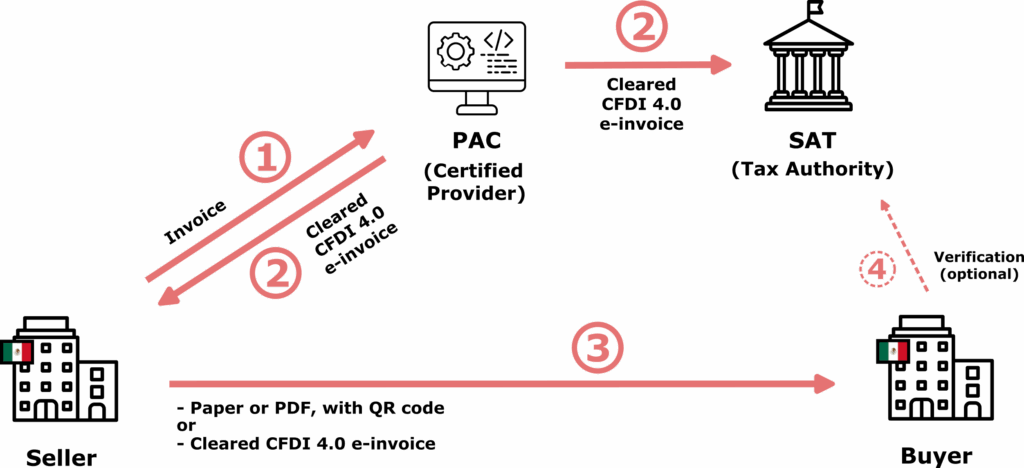

All invoices must be validated in CFDI 4.0 format by the tax authority or certified providers before being delivered by the invoice issuer electronically or in PDF or paper.

What the Law Says

E-Invoicing

The e-invoicing mandate in Mexico was implemented as early as 2014, and follows a Clearance model, requiring invoice issuers to have their invoices validated by the Servicio de Administración Tributaria (SAT), the Mexican tax authority, before they can send them to the final recipients.

More specifically, invoices must be generated in CFDI 4.0 format, (based on XML), and digitally signed using a specific certificate issued by the SAT. Each invoice must then be submitted to a certified provider (PAC) which verifies its content and ensures that both the issuer and recipient are valid entities, and validates the invoice.

Once validated, the issuer receives the signed CFDI invoice with a unique identifier called Folio Fiscal.

The issuer is then responsible for delivering the invoice directly to the final recipient. This can be done by sending the electronic file, a PDF version or a printed copy. Both the PDF and the printed copy must contain a QR code, enabling the recipient to confirm through the SAT portal that the invoice was properly validated.

Invoices must be archived for 5 years.

Timeline

E-invoicing mandatory

CFDI invoice 4.0 format

Latest E-Invoicing News in Mexico

Technical Details

Certified E-invoicing Service Providers (PAC)

The Mexican e-invoicing model heavily relies on Authorized Certification Providers (PAC), directly mandated by the tax authority (SAT).

They are responsible for officially validating invoices (a process known as “Timbrado”) as part of the clearance process, and may also handle additional steps in the e-invoicing workflow, such as the electronic invoice generation, digital signing, and subsequent delivery to the final recipient.

Becoming a PAC involves obtaining official certification from the SAT, which must be renewed annually, and complying with strict legal and technical requirements.

Invoice Format & Signature

Under Mexico’s e-invoicing mandate, invoices must be issued using the CFDI 4.0 XML format.

Then, an electronic signature (CSD, “Digital Seal”) must be applied to all invoices using the e.Firma, a digital certificate issued by the SAT. The Digital Seal securely ties the invoice to the issuer’s identity, helping to prevent fraud by ensuring that only authorized entities can issue valid invoices.

Obtaining an e.Firma certificate requires the invoice issuer to be officially registered with the SAT, and it must be renewed every four years.

Invoice Clearance

If the CFDI invoice has not already been issued and signed by a certified provider (PAC), this is the stage where the PAC’s involvement becomes mandatory.

The invoice issuer must indeed select a PAC that will be responsible for validating the electronic invoice, by verifying the identities of both the issuer and the recipient, and ensuring that the invoice data complies with SAT requirements.

Once validated, the invoice is assigned a unique identifier called the Folio Fiscal, and the PAC digitally signs the XML to seal it, in a process known as Timbrado (“Stamping”).

The “stamped” CFDI invoice is then sent by the PAC to both the SAT and the issuer. The SAT stores it and keeps it available in the Buzón Fiscal, while the issuer proceeds to deliver the invoice to the final recipient.

Invoice Delivery

As is typical in a standard Clearance model, the e-invoicing mandate does not regulate how invoices are delivered to recipients. Businesses are free to deliver invoices either electronically or in PDF or paper.

In most cases, companies will opt for paper or PDF invoices, which must include a QR code that redirects to the SAT’s portal, allowing recipients to verify the invoice’s authenticity.

Alternatively, businesses can choose to exchange electronic invoices by sharing the stamped CFDI file that has been validated by the PAC, and that includes its unique identifier, the Folio Fiscal. These elements guarantee the integrity and authenticity of the e-invoice for the recipient.

The Invoicing Hub Word

Mexico

Mexico has been a pioneer in e-invoicing, particularly in the B2B space.

While many countries treated e-invoicing as a voluntary option for years, Mexico made it mandatory as early as 2014, with obligations starting in 2011 for large companies. Its model, built around certified service providers (PACs), has since influenced newer mandates, such as the upcoming French and Spanish ones.

Mexico also stands out for offering a variety of free tools that help smaller businesses generate and submit invoices directly to the tax authority, making compliance more accessible across the board.

That said, Mexico’s e-invoicing framework remains relatively rigid and inward-focused. The requirement for PAC certification limits access for international providers, and the use of a proprietary XML format adds complexity for multinational companies used to global standards like Peppol or EN16931 (although these standards only became widespread after Mexico had already led the way in e-invoicing).

Additional Resources

Tax authority supervising e-invoicing in Mexico

E-invoicing homepage, resources and free tools on the SAT website

Technical specifications of the CFDI 4.0 format in use in Mexico

Official list of various types of certified service providers

SAT portal used by invoice receivers to verify if an invoice was properly validated

Get your Project Implemented

Gold Sponsor

With expert technical support and tailored consulting, we help global and local companies meet Mexico’s invoicing mandates with ease and efficiency. Whether you're operating in Mexico or need to invoice Mexican partners, we ensure full compliance and operational continuity.

Silver Sponsors

Advertisement

Latest News

France’s DGFiP unveils the official list of Approved Platforms

Additional transactions covered by Israel’s e-invoicing mandate in 2026

Denmark’s Bookkeeping Act final stage and cancellation of OIOUBL 3.0

Webinar – What the 2029 UK mandate means for your business

A tense launch for Croatia’s e-invoicing mandate

📩 Newsletter

Receive the latest e-invoicing news, directly in your mailbox, once a month.