E-Invoicing in Colombia

Last update: 2025, July 28

Summary

B2G, B2B, B2C

Mandatory

All invoices must be validated in UBL 2.1 format by the Colombian tax authority, before being delivered by the invoice issuer electronically or in PDF or paper.

What the Law Says

E-Invoicing

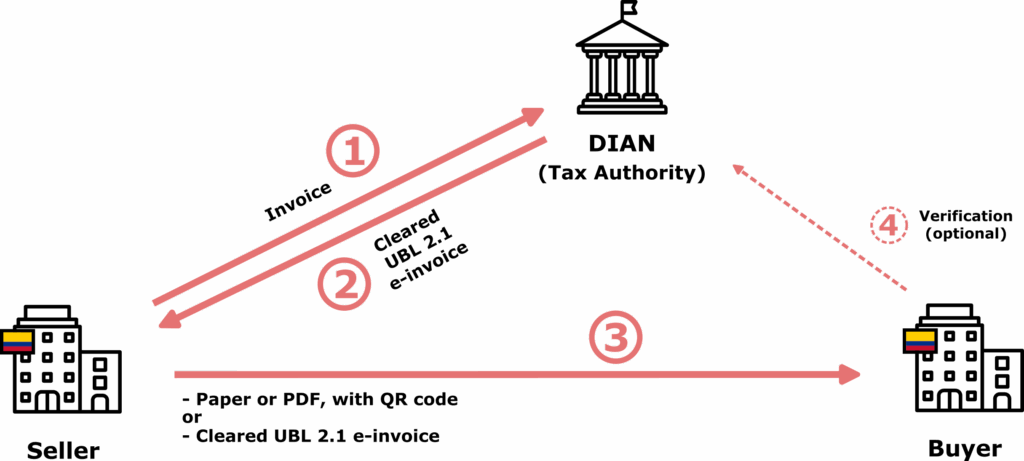

Colombia’s e-invoicing system follows a Clearance model, which requires invoice issuers to first submit their invoices to the national tax authority, DIAN (Dirección de Impuestos y Aduanas Nacionales), for validation. Only after receiving approval can the invoice issuers deliver their invoices to the final recipients.

The Colombian e-invoicing mandate applies to all types of transactions: B2G (Business-to-Government), B2B (Business-to-Business) and B2C (Business-to-Consumer).

Invoices must be issued in a format based on UBL 2.1, digitally signed, and submitted through DIAN’s online platform for validation via the platform’s free online tool or via a certified provider.

Once validated, the issuer is responsible for sending the invoice to the recipient. This can be done by sharing the electronic UBL file, a PDF version, or a printed copy. Both the PDF and printed versions must include a QR code, allowing recipients to verify the invoice’s validity via the DIAN portal. In the case of electronic delivery of the invoice in UBL format, the file must contain the CUFE (Unique Code of Electronic Invoice), which serves the same verification purpose.

Invoices must be archived for 5 years.

Timeline

E-invoicing mandatory for large companies

E-invoicing mandatory

E-invoicing also applies to high-value cash register tickets

Latest E-Invoicing News in Colombia

Technical Details

DIAN Registration Process

In Colombia, businesses that wish to issue electronic invoices must go through a formal process of registration, testing, and enablement with the DIAN. This process ensures that the taxpayer is fully compliant with the legal and technical requirements of the country’s electronic invoicing system.

The first step for each company is registering with DIAN through the Unique Tax Registry (RUT). This registration identifies the taxpayer as a potential electronic invoice issuer. As part of this stage, the taxpayer must:

- Obtain a digital certificate to sign invoices securely

- Select a certified software provider or use DIAN’s free invoicing tool, ensuring the system is capable of generating, transmitting, and receiving electronic documents according to DIAN’s specifications.

The taxpayer must also provide their unique receiving inbox email address, which will be used to receive invoices in their role as an invoice recipient.

After registration, taxpayers enter a testing phase. Upon successful completion, DIAN grants formal enablement, issuing a Notification of Enablement and a Número de Autorización de Numeración (NAN). This authorizes the taxpayer to legally issue electronic invoices and requires ongoing compliance with all related obligations.

Invoice Format & Signature

Colombia requires e-invoices to follow an electronic format based on UBL 2.1 with mandatory local extensions. These additions include specific tax and identification fields required by DIAN.

The invoice must be digitally signed, using the certificate issued by DIAN following the registration phase, in order to ensure authenticity and data integrity.

Invoice Clearance & Delivery

If the invoice content is correct and approved by DIAN’s online platform, the invoice becomes valid and can be sent to its final recipients.

DIAN then issues a Clave Única de Facturación Electrónica (CUFE), a unique electronic invoice code generated from invoice data combined with DIAN’s control key. This code guarantees the invoice’s authenticity, uniqueness, and traceability. The CUFE must be included in the invoice if the issuer chooses to deliver it electronically.

Alternatively, if the invoice is delivered as a PDF or printed copy, the issuer must include a QR code. This QR code, created by the issuer, links to the DIAN webpage for that invoice, enabling quick verification by customers or auditors and ensuring access for those who cannot receive electronic XML files.

Receipt and Acceptance by the Buyer

The recipient must have a receiving inbox email address, which is necessary to receive documents. This address is set up by all Colombian businesses during the initial registration process with DIAN.

After receiving a validated invoice, the recipient may send a formal acknowledgment of receipt. If no commercial rejection is issued within 3 working days, the invoice is considered tacitly accepted by default.

Certified Providers

Many companies will rely on certified providers to manage the entire clearance process, including invoice creation, signature, validation, and delivery.

The alternative is DIAN’s free online tool, which is mainly designed for micro and small businesses, offering basic manual invoice submission with limited automation, volume, and integration capabilities.

An official list of certified e-invoicing service providers in Colombia is available and is maintained by DIAN.

These service providers must be certified by DIAN to operate legally in the country. The certification process involves system testing to ensure compliance with DIAN’s technical standards and is open to both local and international companies that meet all necessary requirements.

It is important to note that using a service provider does not exempt companies from completing their own registration with DIAN. Businesses must still register to obtain authorization to issue e invoices and receive the digital certificate needed for signing.

The Invoicing Hub Word

Colombia

As in many Latin American countries, e-invoicing is mandatory in Colombia and follows a clearance model.

This system ensures that all invoices are validated by the tax authority before being sent to recipients, guaranteeing their authenticity, integrity, and traceability. It also simplifies verification for recipients (through a unique identifier or a QR code), who can be confident the invoices they receive have already been approved by DIAN.

What sets Colombia apart from countries like Mexico is its openness to international e-invoicing service providers. Foreign providers are allowed to go through DIAN’s certification process, enabling global companies to work with familiar partners and easing their compliance efforts under Colombian regulations.

For smaller local businesses, DIAN offers a free e-invoicing tool. While limited in features, automation, and scalability, it provides a practical solution for most small enterprises and supports widespread compliance across the country.

Additional Resources

Tax authority supervising e-invoicing in Colombia

E-invoicing homepage, resources and FAQ by DIAN

Guidelines, specifications, schematrons, validation artifacts, and more

Official list of various types of certified service providers

Mandatory process to be followed by companies for e-invoice issuance and DIAN validation

DIAN’s free platform to submit e-invoices designed for micro & small companies

Get your Project Implemented

Gold Sponsor

Silver Sponsors

Latest News

E-invoicing webinar series to support businesses in New Zealand

E-Invoicing Exchange Summit Middle East 2026 (Dubai, Mar. 30 – Apr. 1)

France’s DGFiP unveils the official list of Approved Platforms

Additional transactions covered by Israel’s e-invoicing mandate in 2026

Denmark’s Bookkeeping Act final stage and cancellation of OIOUBL 3.0

📩 Newsletter

Receive the latest e-invoicing news, directly in your mailbox, once a month.