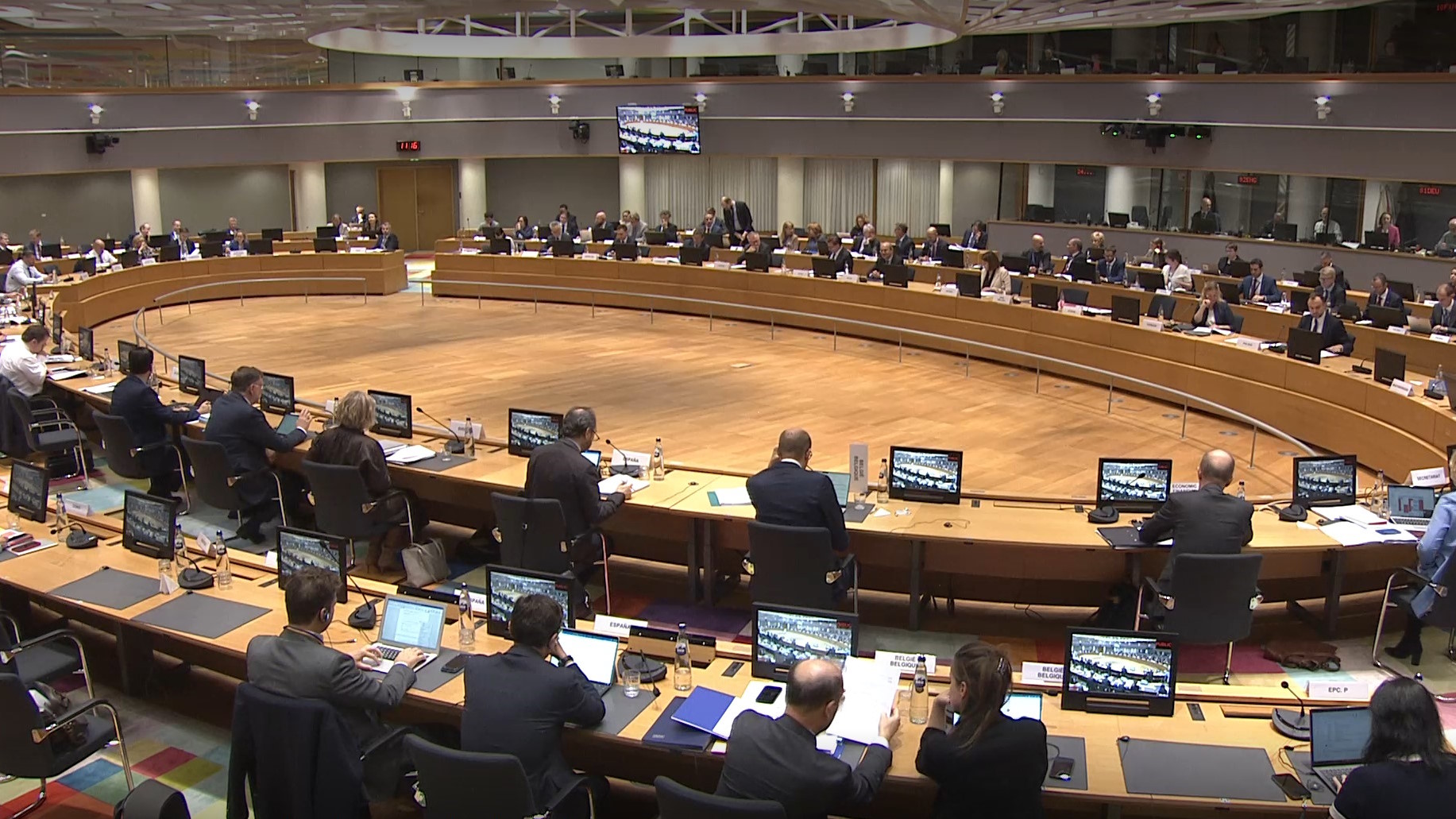

All three pillars of the ViDA (VAT in the Digital Age) package were adopted by the ECOFIN (European Economic and Financial Affairs Council) on November 5 during a public session:

- Pillar 1 – Digital Reporting Requirements (DRR), aimed at generalizing and standardizing e-invoicing and e-reporting across all EU member states.

- Pillar 2 – Platform Economies (online marketplaces, digital platforms), with the goal to facilitate VAT collection.

- Pillar 3 – Single VAT Registration within the EU, intended to reduce administrative burdens for taxable individuals and entities.

Read the official announcement on the European Council website.

A replay of the session is also available (timestamp: 11:32:30 – direct link available at the bottom of the replay page).

This decision comes after delays in May and June 2024, primarily due to debates over Pillar 2 and unrelated to the e-invoicing and e-reporting topics.

Next steps of the legislative process

The compromise resulted in several amendments, primarily concerning Pillar 2, which will require a new vote by the European Parliament.

During the live session, Mihály Varga, Hungary’s Finance Minister and current Chair of ECOFIN, confirmed that the proposed changes were well-received by the Parliament. Representatives from Belgium, Spain, and the European Commission are all strongly advocating for the swift adoption of the package by Parliament.

Then, following the vote, the official ViDA directive will need to be published.

Implications for e-invoicing and e-reporting across the EU

The main impacts of Pillar 1 of the ViDA directive on e-invoicing and e-reporting within the EU include the following:

- Removal of Buyer Acceptance Requirement: Currently, e-invoicing in the EU requires the buyer’s consent—meaning a supplier can only send an e-invoice if the buyer agrees, or if there is a national e-invoicing mandate. With the ViDA directive, buyer acceptance will no longer be required, facilitating e-invoicing adoption.

- Potential New E-Invoicing Mandates: Member states will have the freedom to introduce new e-invoicing mandates without needing to request an EU-level derogation. This change should lead to more B2B e-invoicing mandates being announced and implemented by EU countries in the coming years.

- Mandatory Cross-Border E-Invoicing & E-Reporting by 2030: Beginning July 1, 2030, cross-border e-invoicing and e-reporting will become mandatory within the EU

- EN 16931 becomes the default by 2030: the European Norm (EN) 16931 will serve as the default invoice standard for all transactions, both domestic and cross-border.

- Harmonization of E-Invoicing Systems by 2035: Starting in 2035, all e-invoicing and e-reporting systems across EU member states must be harmonized, likely based on a five-corner DCTCE model.

These changes will have broad impacts across the EU, especially for early adopters like Italy, which will need to adjust their mandate requirements (such as the invoice format and the use of a central platform) to align with the ViDA directive.

The removal of buyer acceptance for e-invoicing introduces new considerations for all European businesses, as most are not yet equipped to receive and process e-invoices, nor fully aware of this potential new requirement.

With these upcoming changes, you can rely on The Invoicing Hub to stay updated and provide valuable resources to help you navigate the anticipated transitions.