Mid-June, 2025 saw a buzz of sizzling activity – despite scorching heat all across Europe! Particularly brewing was the excitement among the record crowd hailing from all types of members and across the globe. This includes (Peppol) Service Providers at its core, but also delegates from almost all Peppol Authorities (23 countries by now!) as well as wide representation of Tax Authority representatives. In total, almost 400 attendees filled the plenary auditorium and the not much smaller Technical Track in the adjacent meeting room at The Square in Brussels, Belgium.

Business Track covers use cases, experience and upcoming mandates

Split into 2 parallel tracks, the Peppol Conference covered in the Business Track

- e-Invoicing and the slew of upcoming B2B mandates, particularly in Europe.

Of particularly relevant note was the presentation of Wouter Bollaert showcasing the fully Peppol-based approach taken in Belgium. - e-Reporting and specifically Peppol-based tax reporting in Europe (Peppol ViDA Pilot project)

- Further extended use of Peppol infrastructure explored in the Enhanced B2B Domain includes many new elements. In particular, delivery of hybrid format invoices (if you can’t help it) or funneling non-XML payloads through Peppol incl. EDIFACT, X12 is possible. An interesting use case adopts bilateral communication models to ease implementation of sub-contracting between Service Providers. This may serve to connect to nationally accredited peers or to gateway services bridging into industry-specific networks.

Deep-Dives on globalization, Europe’s ViDA requirements and continued technical maturing

The Technical Track offered several deep-dives including even a few panels with Peppol experts. Particular interest revolved around the expected revision of the CEN TC434 to the EN16931-1 as reported by Paul Simons. This revision addresses additional requirements due to upcoming B2B mandates. It also resolves errors uncovered in implementations thus far as well as add ViDA-related extensions. Publication is still possible for the second half of 2025, so stay tuned.

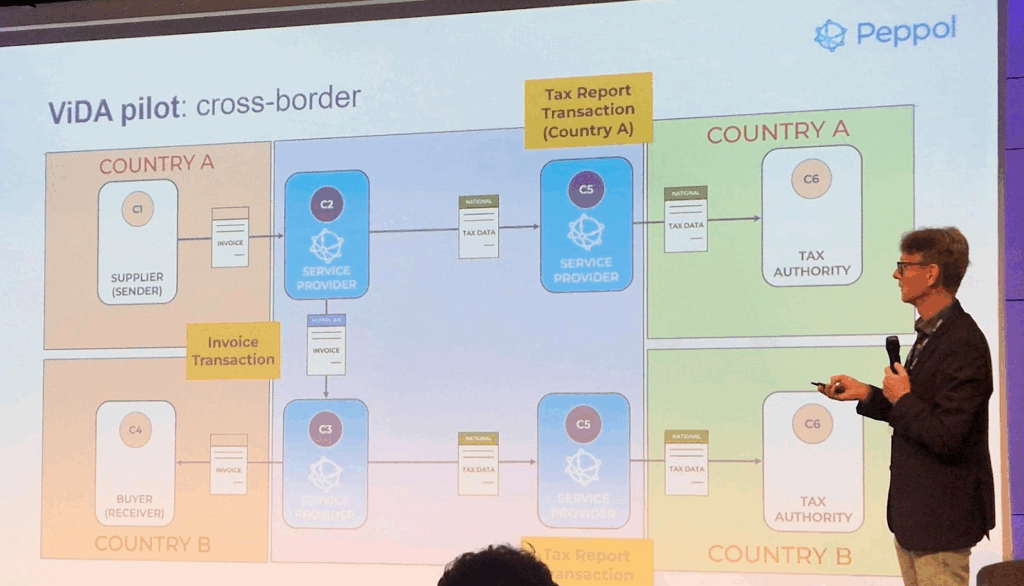

Reporting from the Peppol ViDA Pilot project, our co-founder Michael Walther introduced a view on a Peppol-based IT architecture for the 5-corner model. The project includes more than 20 Tax Administrations in various levels of activity. Indications are that we may have to interpret the “5” in “5 corners” more on a symbolic level. As technical analysis shows, actual implementations may involve anywhere from 5 to 6, 8 or even 12 corners – depending on the method of counting! Still, for simplicity, let’s stick to “5 corners” to denote the entire family of architectures. Overall, adding Tax Reporting to electronic invoicing seamlessly to the participants of the Peppol network certainly is a driver for adoption and growth of the network!

Finally, hard-core technical topics showed the continued maturity process going on in the network! Simple solutions once sufficient to deal with requirements back then now need to be gradually extended and revised to expand reach. This is particularly obvious in the choreography technologies like SML federation and an entire Next Generation for eDelivery and Dynamic discovery. Also, rollout of Message-Level Status (MLS) continues and various internal migrations are in progress to prepare for yet more volume and adoption!

Peppol ViDA Pilot project and Peppol CIWG meetings

Seizing on the opportunity of many of the stakeholders personally traveling to Brussels, several initiatives scheduled face-to-face meetings before and after the conference.

For example, the Peppol ViDA Pilot project presented and discussed a first draft Enterprise Interoperability Architecture. More than 30 participants personally representing 12 tax administrations from across the Europe took another step towards piloting a ViDA implementation in the fall and into early 2026.

On another track, the usually globally dispersed members of the Peppol “Critical Infrastructure Work Group” (CIWG) gathered in a room. The group enjoyed a lively and fruitful discussion on the next generation of eDelivery, Dynamic Discovery and Peppol Directory.

All in all: the community is growing and activity is abuzz!

After spending almost the entire week in Brussels it’s now more clear than ever. The Peppol community is gaining (yet more) momentum, mandates are helping to attract yet more interest to the only viable option of an EU-wide, and maybe global, cooperative network of B2B Service Providers. And both developments drive maturity processes across the network, that seems mundane and technical but are vital to the future viability of the network!