E-Invoicing in Denmark

Last update: 2026, January 15

Summary

B2G

Mandatory

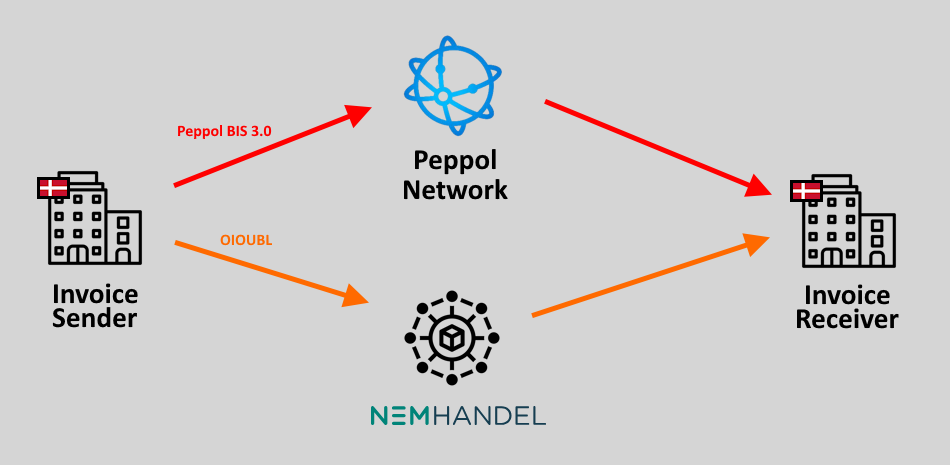

Mandatory via the Peppol network or the national NemHandel platform, either in Peppol BIS 3.0 or in OIOUBL format.

B2B

Mandatory acceptance

E-invoicing acceptance is mandatory countrywide for most companies (beside the smallest ones) using certified accounting software.

What the Law Says

B2G E-Invoicing

E-Invoicing has been mandatory in Denmark for all B2G transactions since 2005 already.

Denmark has implemented a central platform called “NemHandel” to enable the sending & reception of e-invoices, but it is also possible to use the Peppol network as it is interconnected with the NemHandel platform.

E-invoices must be sent either in Peppol BIS 3.0 format (compliant with the European Norm (EN) 16931) or in the local OIOUBL 2.1 format.

Invoices must be archived for 5 years in most cases.

B2B E-Invoicing

E-Invoicing is currently well developed in Denmark, but not fully mandatory yet. Therefore, invoices can be issued currently using any of the following ways:

- Paper-based invoices

- PDF invoices with e-signature or complete audit trail

- EDI

But e-invoicing acceptance is mandatory countrywide, according to a law called the “Bookkeeping Act” that was adopted in 2022, and that was gradually implemented between 2024 and January 1, 2026.

The Bookkeeping Act requires all accounting processes to be performed digitally using:

- Either a digital bookkeeping software certified by the “Erhvervsstyrelsen” (or “ERST”, the Danish Business Authority)

- Or an individual digital bookkeeping solution developed in compliance with the law

All accounting software must support electronic invoicing, by transmitting invoices via either the public NemHandel platform or via the Peppol network.

The invoice format is required to be either Peppol BIS 3.0 (EN16931-compliant) or the local OIOUBL 2.1 format.

The Bookkeeping Act was implemented in 4 phases, the latest ones applying from 2026, January 1, for financial companies (any size) and personally-owned companies with an annual turnover in 2024 & 2025 of more than 300,000 DKK (~40 K€).

The obligation applies from the first financial or income year starting after the relevant phase deadline. As a result, all companies covered by the Act will be required to comply no later than 2026.

Invoices must be archived for 5 years in most cases.

Timeline

B2G Mandatory

B2G E-Invoicing is mandatory for all companies sending invoices to public administrations.

E-invoices can be sent via the Peppol network or the central NemHandel platforrm.

B2G Mandatory Using EN16931-Compliant Formats

B2G e-invoicing must use either the Peppol BIS 3.0 or the local OIOUBL formats.

B2B Mandatory Acceptance - Medium & Large Companies with Certified Software

B2B e-invoicing acceptance becomes mandatory (at the start of the next accounting period) for medium & large companies, that opt for a certified accounting software.

B2B Mandatory Acceptance - Medium & Large Companies with Own Software

B2B e-invoicing acceptance becomes mandatory (at the start of the next accounting period) for medium & large companies, that opt for their own software specifically developped in compliance with the law.

OIOUBL 3.0 becomes mandatory for OIOUBL invoices (cancelled!)

Now Cancelled!

E-invoices sent through NemHandel in OIOUBL format will have to use the version 3.0 of the syntax.

B2B Mandatory Acceptance for All Companies

B2B e-invoicing acceptance becomes mandatory (at the start of the next accounting period) for all companies in Denmark, except those with an annual turnover < 300,000 DKK.

OIOUBL 2.1 becomes deprecated (cancelled!)

Now cancelled!

Exchanging e-invoices through NemHandel in OIOUBL 2.1 format will no longer be allowed.

Latest E-Invoicing News in Denmark

E-Invoicing named key enabler in EU’s Single Market Strategy

OIOUBL 3.0 delay officially confirmed in Denmark

Technical Details

B2G & B2B E-Invoicing

E-invoicing is mandatory for all B2G transactions in Denmark, and all companies must be able to receive electronic invoices for all B2B transactions.

According to the Bookkeeping Act, the entire invoicing process must be managed using a certified digital bookkeeping solution or a homemade solution specifically developped in compliance with the law.

Choosing the Proper Platform

Both the B2G e-invoicing mandate and the Bookkeeping Act state that e-invoices must be transmitted using:

- The Peppol network

- Or the NemHandel central platform built by the Danish government

Peppol and NemHandel are 2 similar implementations of the four-corner model. However, while most Danish public administrations are reachable via Peppol, it’s not yet the case for 100% of them.

Consequently, the NemHandel platform may seem the best e-invoicing choice in Denmark. However, the Danish government has announced that at some point, when Peppol will have reached a sufficient level of functionalities, the NemHandel platform will be discontinued. It’s not planned for the next years, but it’s something to keep in mind.

Company Identifiers as Electronic Address

To check the availability of any public administration on either of these networks / platforms, you can use the NemHandelsregisteret (NemHandel online directory) or the Peppol Directory. Danish private companies & public entities are identified with their GLN (Global Location Number) or their CVR number (Centrale Virksomhedsregister, the Danish Central Business Register).

E-Invoice Content

All electronic invoices in Denmark must be issued in one of the following formats:

- The Peppol BIS 3.0 format, EN16931-compliant, to be used on the Peppol network

- Or the OIOUBL 2.1 format, to be used on the NemHandel network, and which is comprised of more fields to cover Danish requirements more closely. Since May 2022, OIOUBL version 2.1 is valid and in use.

A version 3.0 of the OIOUBL format, compliant with the EN 16931, was released in November 2024 and should have become mandatory in May 2026 (following several delays), but was formally cancelled on 2026, January 14.

E-invoicing in Denmark Overview

The Invoicing Hub Word

Denmark

Denmark and all the Nordics countries have been pioneers of electronic invoicing. E-invoicing even became mandatory for all B2G transactions with central public administrations as early as 2005, which puts Denmark at the forefront of e-invoicing in Europe and even in the world!

And now Denmark is going one step forward, or should we say several steps forward at once. Indeed, the new “Bookkeeping Act” will move a lot of business processes onto the digital road, and among them the invoicing.

However, this law is very monolithic and can make things very complicated for companies, service providers and software developers. Indeed, the main principle of this law is to mandate the use of a certified solution, or to let companies build their own solution in compliance with the law.

As such, many companies will be led to choose comprehensive solutions that handle all the accounting processes, but such a solution does not exist. There are invoicing software, ordering software, treasury management systems, etc., and not one solution covers properly all the accounting processes.

Consequently, this new law may reduce the granularity of the solution landscape that companies have at their disposal, and force them either to move to sub-par do-it-all solutions, or to build their own solution at their own expense & risk.

Similarly, this law has a huge impact on service providers by almost closing the Danish market to many of them: the ones that won’t be able to find a partnership with a bookkeeping software editor. It may lead to a lack of competition and possibly later to a drop in quality of all accounting solutions (including the e-invoicing solutions) on the Danish market.

Additional Resources

Public entity supervising e-invoicing in Denmark

Requirements for digital standard bookkeeping systems & text of the Bookkeeping Act

Continuously updated list of registered bookkeeping systems

Official directory of entities connected to NemHandel

Official directory of worldwide Peppol-ready businesses

Entire set of official Peppol BIS 3.0 specifications

“Release Candidate” of the specifications of the now cancelled OIOUBL 3.0 format (Danish only)

Official OIOUBL 2.1 specifications (Danish only)

Get your Project Implemented

Gold Sponsor

Silver Sponsors

Latest News

Denmark’s Bookkeeping Act final stage and cancellation of OIOUBL 3.0

Webinar – What the 2029 UK mandate means for your business

A tense launch for Croatia’s e-invoicing mandate

New exemption threshold and grace period for Malaysian small enterprises

Mandatory e-invoicing takes effect in Belgium

📩 Newsletter

Receive the latest e-invoicing news, directly in your mailbox, once a month.