France is set to implement a new e-invoicing mandate for all B2B transactions, scheduled to take effect via a phased roll-out in 2026 and 2027. It will impact up to 8 millions companies (including the “autoentrepreneurs”, a simplified form of single-person entrepreneurship), highlighting the immensity of the task ahead.

To that effect, and in order to combat misconceptions about e-invoicing, the DGFiP has published an information campaign (in French only!) in the form of 5 true/false assumptions:

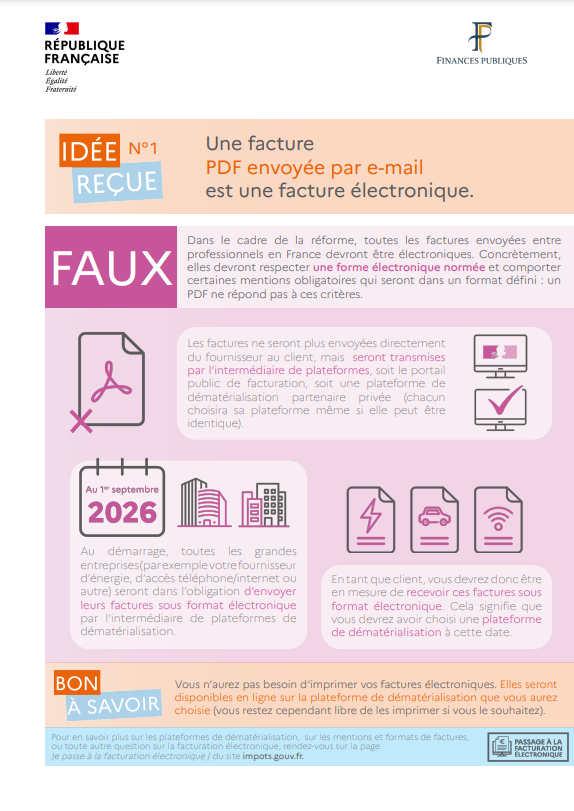

- A PDF sent by email is an electronic invoice

❌ WRONG

➡️ All invoices must respect a standardized structured format - Suppliers are allowed to send their invoices by email

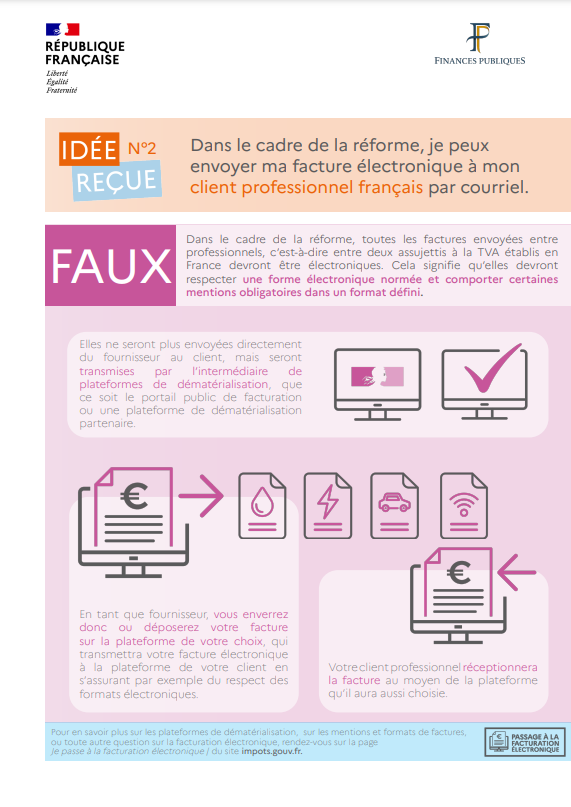

❌ WRONG

➡️ All invoices must be sent electronically through a central platform (PPF) or certified private platforms (PDPs) - My customer is not subject to VAT: I am not impacted by the upcoming B2B mandate

✅ RIGHT

➡️ Invoices addressed to private individuals or organizations exempt from VAT (such as associations) are not required to comply with the e-invoicing mandate - I am an “auto-entrepreneur”: I am impacted by the upcoming B2B mandate

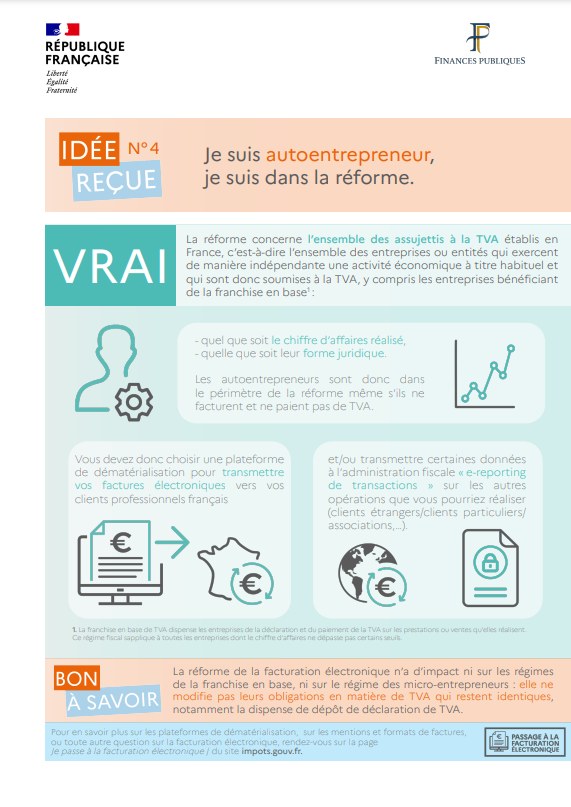

✅ RIGHT

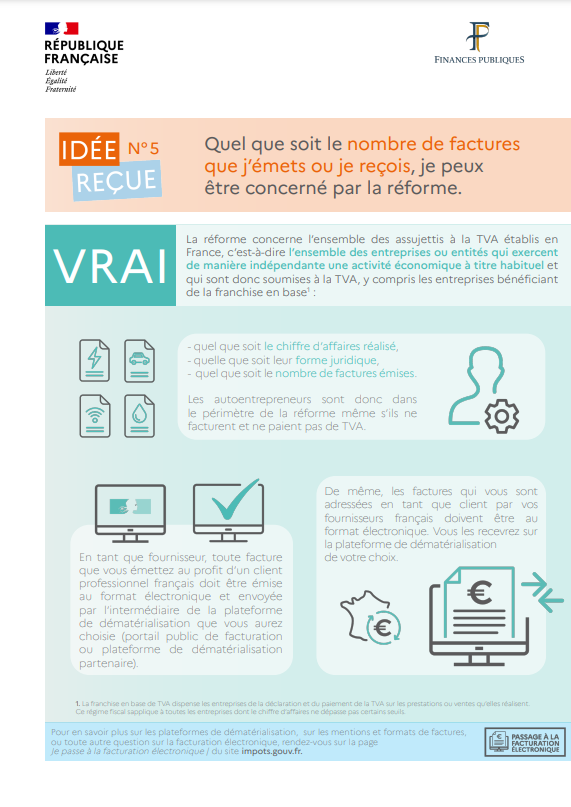

➡️ Autoentrepreneurs fall within the scope of the B2B mandate and must adhere to its regulations, including the adoption of electronic invoices - I am impacted by the upcoming B2B mandate, no matter how many invoices I’m sending

✅ RIGHT

➡️ Companies included into the B2B mandate perimeter must ensure compliance from their very first invoice

Additional fact sheets may be published in the future on the dedicated page on the impots.gouv website.

No comment yet, add your voice below!