E-Invoicing in Israel

Last update: 2026, January 6

Summary

B2G

Not mandatory

There is currently no obligation to use e-invoicing for B2G transactions in Israel.

B2B

Partially mandatory

Clearance required for high-value B2B invoices through a central platform (SHAAM).

B2C

Not mandatory

There is currently no obligation to use e-invoicing for B2C transactions in Israel.

What the Law Says

B2B E-Invoicing

Israel is in the process of rolling out a nationwide B2B e-invoicing mandate based on the Clearance model. The initiative, led by the Israel Tax Authority (ITA), aims to focus on high-value invoices as a way to curb off-the-books transactions.

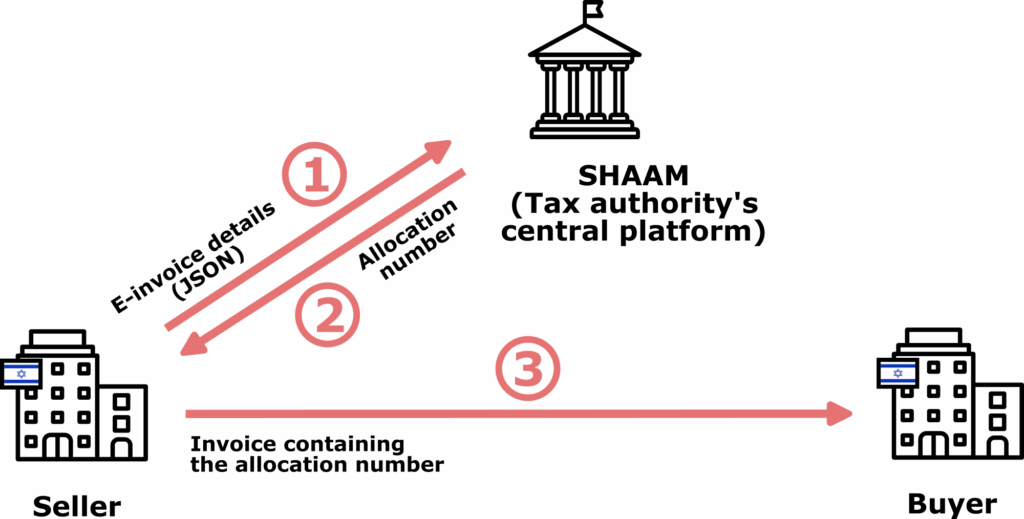

Under this framework, Israeli companies must submit their invoices to the SHAAM central platform for validation before they can claim VAT deductions.

To do so, companies need to share specific invoice details either via the platform’s API in JSON format or manually through the government web portal.

Once approved, the invoice receives a unique Allocation Number, which must appear on the invoice itself. After validation, the supplier can send the invoice to their customer in any format of choice (paper, PDF, electronic, …).

The rollout of this mandate is being carried out in phases. Although the launch was initially postponed due to the Israel–Palestine conflict, the ITA has recently shortened the implementation timeline. The current schedule, based on invoice pre-VAT amounts, is as follows:

- May 5, 2024: mandatory for invoices above 25,000 NIS (~€6,250)

- January 1, 2025: mandatory for invoices above 20,000 NIS (~€5,000)

- January 1, 2026: mandatory for invoices above 10,000 NIS (~€2,500)

- June 1, 2026: mandatory for invoices above 5,000 NIS (~€1,250)

B2G & B2C E-Invoicing

The e-invoicing mandate currently implemented in Israel does not encompass B2G or B2C invoices. Consequently, they are allowed in all the usual formats:

- Paper-based invoices

- PDF invoices with e-signature or complete audit trail

- EDI

Timeline

B2B e-invoicing mandate phase 1

Phase 2 & end of grace period

B2B e-invoicing mandate phase 3

4th and final phase of the mandate

Latest E-Invoicing News in Israel

Understanding the e-invoicing clearance model in Israel

B2B Technical Details

Initial registration procedure

Any company, company representative, or software provider wishing to operate under the B2B e-invoicing mandate must first register with the SHAAM central platform.

Officiel registration guidelines have been shared: applicants are required to complete, sign, and upload a set of documents via the online portal.

Furthermore, only software providers are authorized to connect to SHAAM through the platform’s API. Consequently, they carry additional obligations regarding data confidentiality and security (such as mandatory, recurring penetration tests). Their registration is more rigorous and must be reviewed and approved by SHAAM personnel before API access is granted.

All companies registered with SHAAM are provided with a personal workspace, where they can view both their sent and received invoices.

Invoice Clearance

For any invoice that exceeds the threshold defined by the e-invoicing mandate, electronic invoicing becomes mandatory.

In practice, invoices must be cleared through the SHAAM central platform, which can be accessed either via API (mostly for software providers) or through a government web portal (which means manual input).

Companies issuing large volumes of invoices will generally benefit from working with software providers to automate the process. However, since these providers are not officially certified by the ITA, no public registry exists, meaning companies must independently select their preferred solution.

Invoices submitted via API must be transmitted in JSON format and include key details:

- The customer’s authorized reseller number

- The amount before VAT

- The VAT amount

- The invoice number on which the allocation number will be written

Once validated, SHAAM returns an allocation number, which serves as proof of clearance.

Although not mandatory, companies may also voluntarily submit credit notes and invoices below the threshold for clearance. An allocation number can also be requested retroactively, within 6 months of the invoice issuance. However, the related VAT cannot be deducted until the allocation number is obtained.

Invoice Delivery

In line with the standard clearance model, the e-invoicing mandate does not regulate how invoices must be delivered to recipients. Companies are free to exchange invoices in any mutually agreed format, whether electronic or paper-based.

Regardless of the chosen format, the invoice must include the allocation number, which serves as proof that it has been cleared and that VAT is deductible.

Recipients can then verify the validity of this allocation number within their personal workspace on the SHAAM central platform.

The Invoicing Hub Word

Israel

From a technical perspective, Israel is implementing a rather classic clearance-based e-invoicing mandate: invoice data must be transmitted to a central platform, which then returns a unique identifier that must appear on the invoice sent to the customer.

What sets Israel apart, however, is its unusual decision to set thresholds not by company annual revenue, but by individual invoice amounts. The final threshold remains relatively high, at more than €1,000.

This approach seems intended to reduce the burden on businesses. Yet, it also means that many companies issuing large volumes of low-value invoices are excluded from the mandate, despite being among those who could gain the most efficiency from e-invoicing.

Conversely, small businesses issuing only a few high-value invoices have been impacted since the very first phase of the mandate and therefore had less time to adapt.

Moreover, because the mandate is limited to a simple clearance model, without regulating invoice delivery, most companies are likely to continue relying on paper or PDF formats. These formats remain prone to long processing times and manual errors, preventing true automation.

Still, this represents a first step. Time will tell whether Israel chooses to extend the scope of its mandate and fully embrace the broader benefits of e-invoicing.

Additional Resources

Tax authority supervising e-invoicing in Israel

Official specifications for e-invoicing in Israel, including API & invoice model description

Official FAQ on the B2B e-invoicing mandate in Israel

Official compilation of Q&As addressed during an official presentation of the e-invoicing mandate

Detailed guidelines to register with & connect to the SHAAM central platform

Get your Project Implemented

Gold Sponsor

Silver Sponsors

Latest News

Greece’s B2B mandate to start one month late, on March 2

Peppol G2 to G3 certificate migration on April 1st 2026

E-Invoicing Compliance in the UAE: The Complete Guide

Sweden to assess implementation of domestic e-invoicing

Webinar – France’s digital leap: preparing for mandatory e‑invoicing in 2026

📩 Newsletter

Receive the latest e-invoicing news, directly in your mailbox, once a month.