As announced recently, the ECOFIN meeting on 14.5.2024 considered the three pillars of the VAT in the Digital Age (ViDA) for adoption as a whole. Participating ministers of finances exchanged views on each of the pillars, achieving overall progress towards agreement. In particular, the views on the pillars were

- Digital Reporting Requirements (DRR) are agreed in the compromise text including a revised timeline as published before the meeting

- Single VAT Registration is also agreed in the update compromise form

- VAT Treatment of the Platform Economy contains a “Deemed Supplier regime” agreed by all members states except one and needs more work before unanimous agreement

From an e-Invoicing point of view, this means that the updates outlined in the published material are expected to remain largely unchanged and may serve as a preliminary basis for planning further activities. See European Council considering ViDA on 14.5.2024 for a quick overview and further pointers.

“Further work” needed

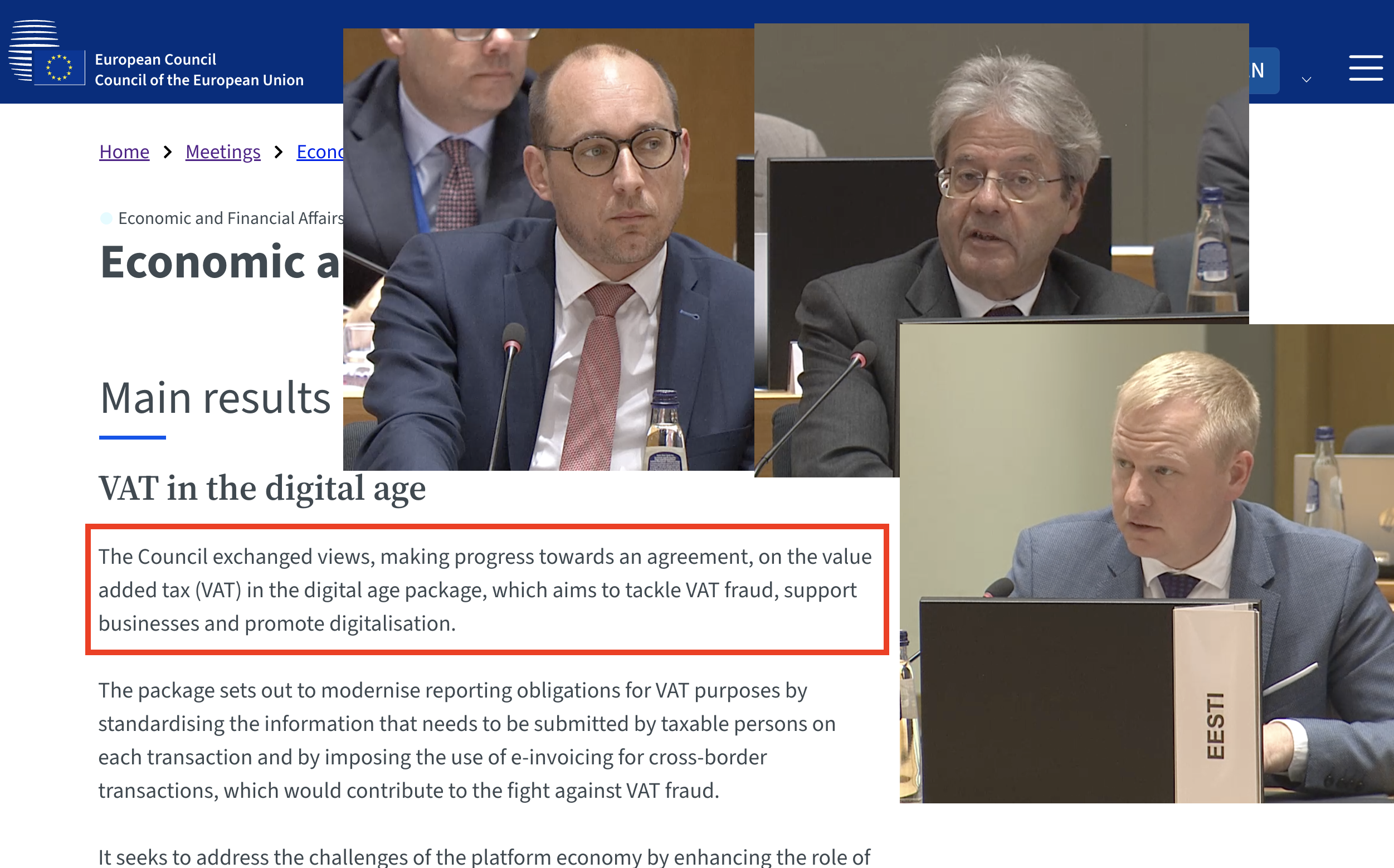

Estonian Finance Minister Mart Võrklaev stated the view that “further work” is needed to achieve an agreement on the “Deemed Suppliers regime” in the tax rules for the platform economy. European Commissioner Paolo Gentiloni emphasized the spirit of compromise and value of agreement to no immediate avail.

Belgian Finance Minister Vincent van Pethegem expressed confidence that with continued work on the remaining topic an agreeable compromise can still be reached for the entire ViDA package within the Belgian presidency in the first half of 2024. The opportunity arises on the next ECOFIN meeting, scheduled for 21.6.2024 (planned meeting agenda)

The so adopted then, the outlined texts solidify into a more reliable and concrete frame to current and related future activities in e-Invoicing. Until then, the suspense continues – although the target picture has quite clarified in the last week!